Cross-Channel Engagement: the Recipe for Closing Deals

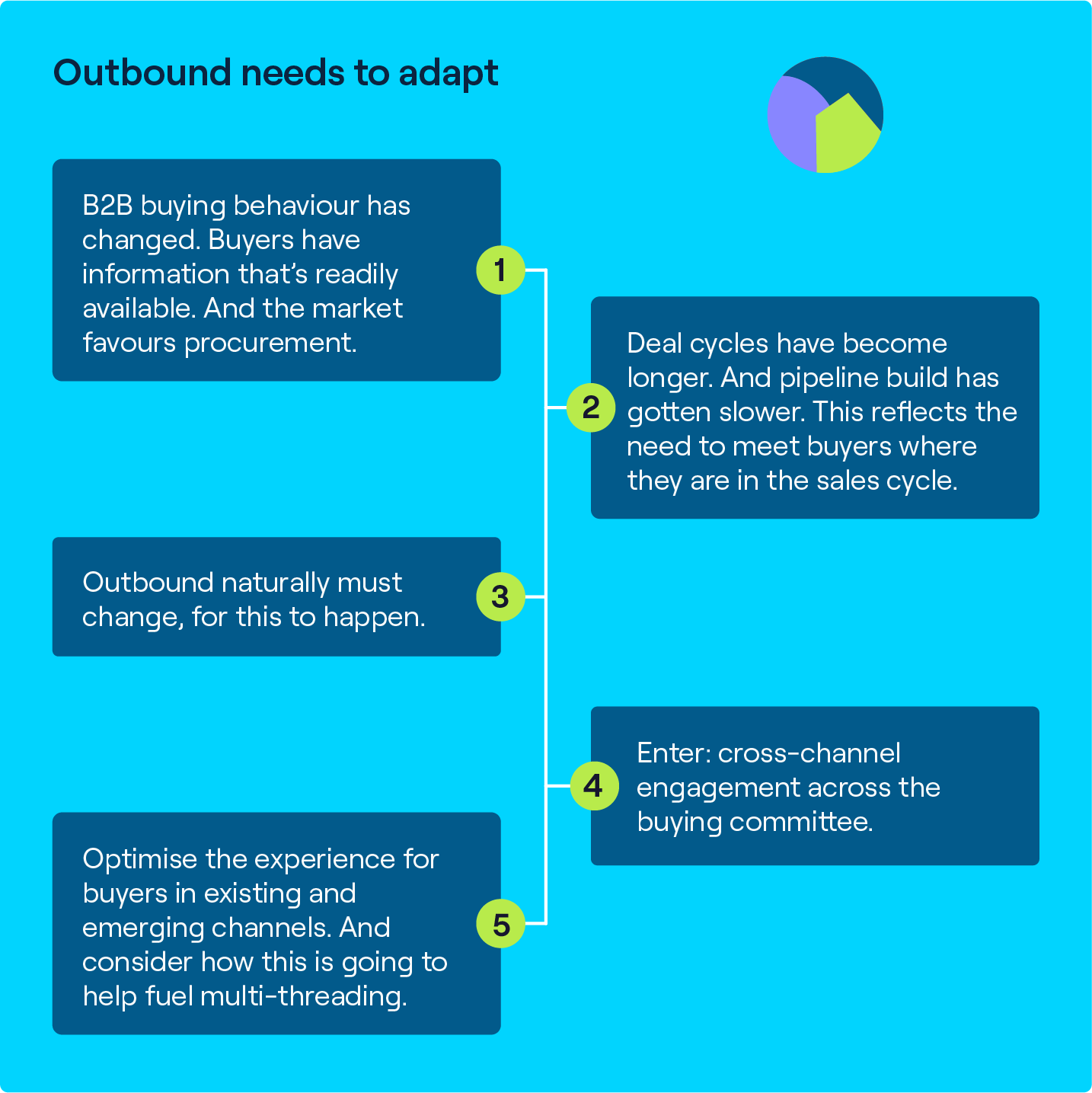

B2B buying behaviour has changed - period.

Over the past five years, there’s been a real shift in the state of play.

1️⃣ Buyers have more information than sellers realise.

Much of the due diligence and information prospects need are already readily available to them.

For example, the rise of review sites like Trustpilot and G2.

2️⃣ The sales process has become more complex.

The power to move the needle on a deal isn’t just down to one c-suite executive anymore.

3️⃣ Buyers are digitally-centric.

With the rise of remote work, the reliance on communication via online channels, like Zoom and Slack, has become paramount.

These trends need to be taken into account. Because they can all impact whether deals are going to lose momentum.

In face, we’re already seeing deals taking longer to close. Just look at this study from Gong ⬇️

Between 2020 and 2022, they found that the % number of deals that were closed by the end of the year dropped from 69% to 61%.

Clearly, sales teams need to reflect that with the way they approach outbound.

Enter the power of cross-channel engagement across your buying committee.

This is the topic of this article, featuring insights and LinkedIn posts from a wide range of different sales leaders:

- Jonathon Ilett, VP of Sales for UK&I at Cognism.

- Thomas Allcock, Enterprise Sales Manager at Cognism.

- Ryan Scalera, Head of Business Development at Flosum.

- Mattia Schaper, Co-Founder at SDRs of Germany.

- Andy Byrne, CEO at Clari

- Rory Sadler, Co-Founder and CEO at Trumpet.

So, let’s get into it. Scroll 👇 or use the menu to navigate the page.

Does traditional outbound still have relevance today?

‘Cold calling is dead.’

‘Video has no relevance.’

‘Emails aren’t going to be read by prospects.’

The source of these statements stems from a couple of things ⬇️

It's too much hassle or work

It’s often the case that teams will try something once and then often feel like they should give up if they don’t see the results.

As a sales leader, it’s important to do the following:

Remind your sellers that they aren’t going to always be graced with beginners' luck when it comes to outbound.

Ryan offered insight into this:

“All outreach channels need to be practised. Nothing’s going to be amazing on the first try.”

“So if we take video prospecting as an example, there’s a common misconception that it doesn’t work. Because a seller will send a video, not do a good job at it (because they aren't even sure what a good job looks like), and then conclude that it doesn’t work.”

So, what’s the solution?

“Treat all the forms of outreach the same. Define and create a process, and then iterate on what works and what doesn’t.”

A lot of the time, there might be pushback, because of a belief that it will waste a rep’s time. Especially in larger organisations where workflows and processes might already be set up.

Ryan once again used video as an example here:

“Other channels that aren’t typically as labour intensive seem to be the preference. So it’s not uncommon for sellers to say that video will take too long. But with the current state of outbound, this is a rookie error.”

The channel is too saturated

It’s a valid concern.

But that doesn’t mean SDRs shouldn’t pursue outbound in these channels.

It comes down to understanding how your team goes about leveraging the different strengths of the channels. And how they’re shaping up in a cross-channel engagement strategy.

For example, Ryan said that one of the best ways to use video is through LinkedIn:

“It arrives directly in the buyer’s inbox, and it’s a pattern interrupt. When you get a video in an email, it’s not as uncommon compared to via social media. So there’s a higher chance of them clicking and watching it, as opposed to a generic text pitch.”

The bottom line?

Enable reps to experiment - that’s how to optimise the experience for the modern-day buyer.

How to optimise the channel experience for buyers

Buyer centricity is crucial.

Once this is in your head, outbound will be much more valuable.

Ultimately, if you don’t put the buyer first, the number of responses and meetings booked won't be high.

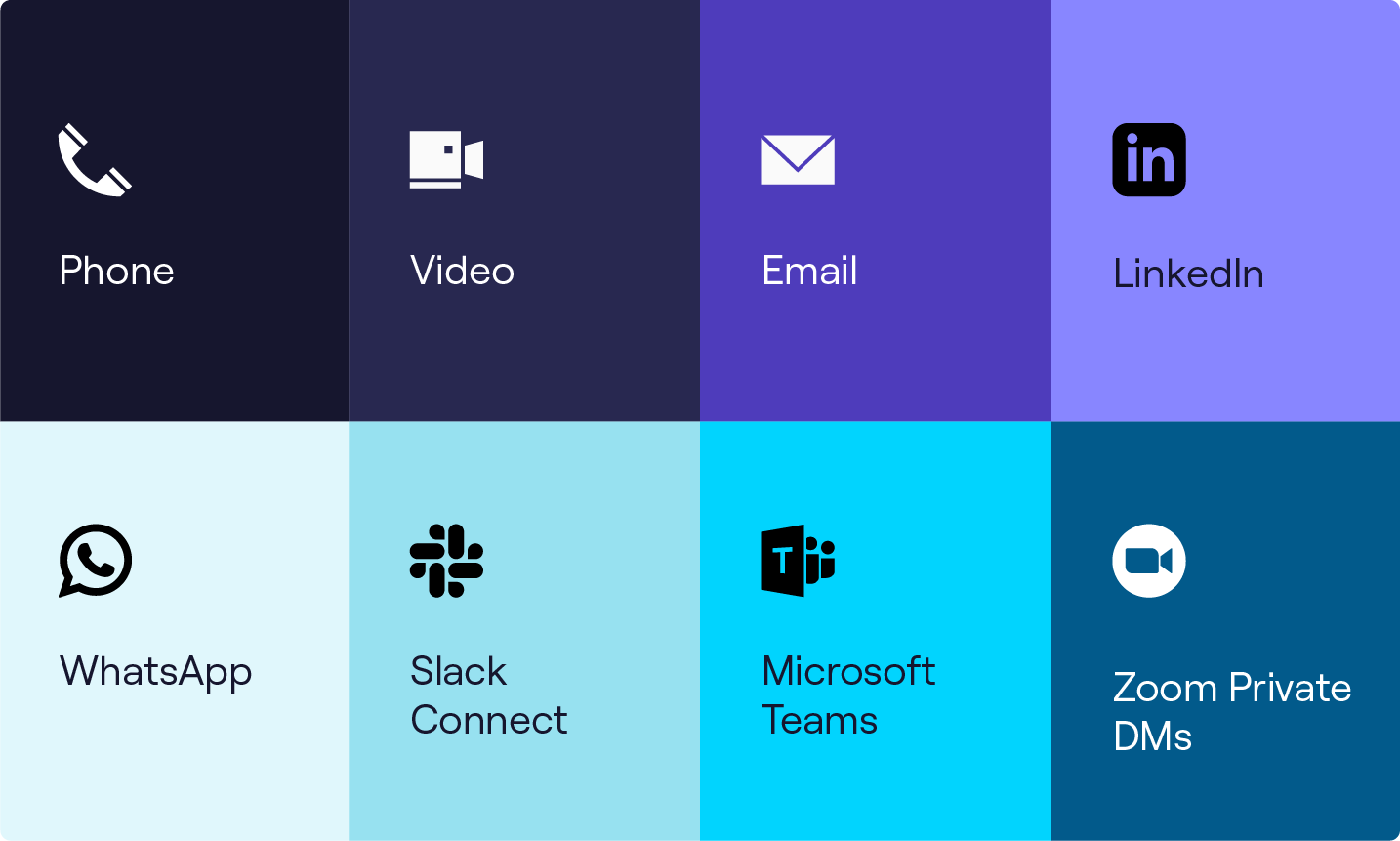

As a reminder, here are some core channels (old and new) that are relevant for outbound ⬇️

Now, the question is, how can sellers go around optimising channel experiences?

1. Consider different channel preferences

It’s not a set-in-stone approach that a CFO has a preferred set of channels over a CEO.

It just has to come down to a bit of trial and error.

Tom explains more:

“A good place to start is the more personal, the better. And this lies in the messaging and how buyers are being contacted. This is why I’m a big fan of a call - it’s the ultimate way to communicate. Because it streamlines the whole process.”

He added:

“That being said, if you do have to message someone, and if they’ve allowed you to speak to them over the phone, it’s perfectly fine to send them a quick WhatsApp or text.”

“If a prospect has indicated that they’re interested, it’s perfectly reasonable to send a follow-up text. Not only is it creative, but it’s more convenient.”

He reminded us of the core principle here:

“Just test and see what’s relative to the customer and what they prefer. It shows proactivity, because you’re finding the best way to communicate and respecting the preference.”

2. Identify where the channels fit within the sales process

Some channels will be relevant at some points in the sales cycle, more than others.

Let’s start with video as an example.

We asked Ryan about the different types of videos that teams can use:

“I recommend multiple different types of videos. First of all, there’s a post-discovery video. Recap the three highlighted points you find on the discovery, and then three things you’ll show on the demo. I’d also outline extra questions you’d like to know before the demo.”

He added:

“An AE has a way better chance of using video in the sales cycle. They know a lot about the buyer, so there’s scope there.”

“For example, send a video recapping the three potential stakeholders that you’ve already spoken to in the org, and then offer a value prompt. Then send it to someone higher up in the organisation. That’s how you can get to power in a deal.”

The key takeaway here?

Use video to accelerate the sales process, especially after making that first interaction.

Think about the messaging your reps use in different stages of the funnel too.

Here’s a useful post from Gong that helps to illustrate what we mean by this 👇

3. Consider how your reps are going to stand out from the crowd

Firstly, encourage teams to get creative and experimental with their outreach - that’s the secret to winning in this market.

Mattia agreed, saying:

"Do what others aren't doing. For example, in my first few months at SalesLoft, I remember booking meetings through cadences that were just memes. Because nobody else was doing it at the time."

Ryan agreed:

“In a video, most people are standing there with a whiteboard. But instead, it’s best to design a thumbnail via Canva with the seller and prospect’s face on it. It shows that the video was meant for them. It’s a way to engage and stand out.”

“You can take it a step further by writing text on the thumbnail too. Something like:

‘Hey [INSERT BUYER’S NAME], I thought you’d find this interesting.’

Secondly, think about how much your sales reps rely on automation. Are they making a conscious effort to personalise outbound?

Jon explained why it’s important to consider this in the clip below:

The importance of emerging channels

Jump on the bandwagon now. They will be a long-term win to help start conversations and book meetings.

Here are a couple to bear in mind 👇

At first glance, WhatsApp can seem intrusive.

And it’s not entirely untrue - some prospects will react negatively. But there’s also a strong chance that WhatsApp responses will be really strong.

Ryan explained more:

“Because it’s such a unique outbound method, WhatsApp and texting can seem invasive to some prospects. But there are also ways to soften this impact.”

Want to know more? See Cognism’s blog on WhatsApp sales.

Slack Connect

Building a sense of community and cohesiveness in outbound is essential. Especially later on in the sales process, when dealing with different decision-makers.

Here’s a post from Jon to explain more:

The importance of the buying committee

There’s been a notable rise in the importance and influence of C-suite executives when it comes to the time it takes deals to close.

In another study, Gong found that ⬇️

Between 2020 and 2022, the % number of won deals with a VP+ in attendance increased from 11% to 17%.

That’s a pretty big jump, if you ask us.

Now, what does this mean for sellers?

Well, it’s not enough to just reach out to one stakeholder or decision-maker anymore.

You must be able to multi-thread and provide value to everyone that’ll impact a deal.

A seller’s fate is, quite literally, in the buying committee’s hands.

What is a buying committee?

Tom explained it from the enterprise sales perspective:

“Essentially, it encompasses everyone making the purchasing decision, impacting the sales cycle. And from an enterprise level, the buying committee can be a lot bigger than people think.”

“For example, you can have between 7 to 20 decision-makers. And they’re not always going to be C-suite level. Sometimes, it can be an entire board, who will be concerned with whether the product will align with growth plans, for instance.”

The key takeaway here?

Understand what matters to these different decision-makers. And tailor outreach accordingly.

Get started by browsing Cognism’s cold calling script swipe file.

For example, here are some CFO pain points from Andy that are worth considering:

How can ever-growing buying committees be navigated?

Planning is everything here.

Tom gave his thoughts on why:

“You can usually make a pre-emptive plan relative to the size of the enterprise you’re dealing with. For example, if you’re dealing with a 5,000 to 10,000 employee organisation, you will have a much larger buying committee.”

He also said:

“You can have a framework in place that can target the multiple threads that you’d typically see in a sales cycle, relative to the product you’re selling. For example, within the context of Cognism, it’s people at the sales management level. But then it can also include the CRO, CFO, and the legal team too.”

But be warned - there’s such a thing as a plan that’s far too rigid. Tom said:

“Definitely go in with an expectation and a plan, relative to what a typical enterprise sale would look like. But then at the same time, be malleable enough to spot the differences.”

“For instance, just because it’s a smaller organisation doesn’t mean that it’ll be a less complex process. For example, a commercial company might have the same experience as an enterprise because of a large procurement process.”

The art of multi-threading & best practices

Rory explains why multi-threading is the future of outbound sales:

Now, what about touchpoints? When dealing with multiple stakeholders, is there such a thing as too many or too few?

Well, Tom gave his insights, based on a recent deal that his team was involved in:

“One of the key learnings was the importance of keeping stakeholders engaged at a high frequency. In other words, it was crucial to keep touchpoints high and front of mind.”

He went on to explain why:

“Deals can lapse in terms of timeframe if you’re not at the top of stakeholders’ minds. It’s important to remember that they’re dealing with anywhere between 30 to 50 projects at any given time. Your product is arguably a tiny part of their day, even if it’s an important solution.”

So, what is Tom getting at here? Well, it’s about taking initiative.

“You have to be reactive AND proactive. It’s not enough to do outreach once and just wait and see.”

Jon agreed, saying that you can take initiative through something like an open LinkedIn chat:

"Using a higher number of channels actually becomes more prevalent the later down the funnel you go. I encourage AEs to create open chats on LinkedIn with multiple people. This comes in handy when we're running trials and evaluations."

Tom also said:

“I remind reps that the prospect isn’t buying your product to do you a favour. They’re buying it because there’s a need there. So, within reason, contacting them a bit more frequently than you typically would, isn’t going to be annoying.”

This is where cross-channel engagement becomes useful. You can contact your decision-makers on different channels, and then double-down on what works.

Now, before you get any ideas, that doesn’t mean you’ve got permission to spam.

“Don’t message three times a day until the stakeholder replies. But within reason, if you’ve set time frame expectations of the next step in a deal, it’s more than reasonable to chase that person up.”

Persistence is key.

Key takeaways

That was a lot of information.

Let’s recap ⬇️

Listen to 'Redefining Outbound'

If you’re curious to explore how the landscape of outbound has changed, tune in to our podcast for sales leaders, called “Redefining Outbound” ⬇️

%20Campaigns%20-%20FR%20copy%202.png)