How to Identify Risky Sales Deals and Improve Pipeline

What's on this page:

The time it takes for deals to close is on the rise.

According to a 2023 report by Ebsta and Pavilion, pipeline generation was down 47% last year.

This matters, because it’s a sign you need to invest your energy into sourcing the right deals - for instance, accounts with high ACV and long contract dates.

Those will help move the needle in creating high-quality pipeline.

In this article, we’ll cover how you can equip your team to be more proactive and efficient when evaluating deals coming through the pipeline.

We’ll feature insights from a range of sales leaders, including:

- Frida Ottosson, Cognism’s VP of US Sales.

- Gina Ruscio, Cognism’s Chief of Staff, Revenue.

This article will unpack how you can identify sales deals that are at risk of falling through, at the early and later stages of the sales process.

We’ll also unpack the influence that MEDDIC or MEDDPICC has on identifying risky deals.

Scroll for more insights 👇

Early stage deal coaching

For Frida, this has been crucial for her team.

And she shared a pretty useful analogy with us to explain why:

“Imagine an asteroid is coming towards earth. If you do something about it when the asteroid is far away, you only have to change direction a little bit so it doesn’t collide. But if you try to change when the asteroid is closer, it’s hard.”

“I’ve found that when managers get ahead and coach on deals early on, that has the biggest impact on deal outcome.”

This is why Frida introduced early stage deal coaching office hours (shorter name TBC 😅).

She said:

“People will bring a deal that’s in the early stages. For example, they’ve just had the first call and that’s it.”

These sessions are split into two parts, starting with:

The info-gathering process

The sessions usually kick-off with gathering top-level information, such as who the rep was talking to and what they were talking about.

Frida then coaches the SDR on the importance of defining value during these sessions:

“I want to get the rep to understand the value of the deal. In other words, what’s in it for the champion? Is there a vested interest? Who else needs to be involved? What’s going to be a blocker?”

That last point regarding blockers is especially important, as Frida outlines below:

“Let’s say a CRO is going to be a blocker. It’s better to find that out three months in advance, to ensure no more time is wasted.”

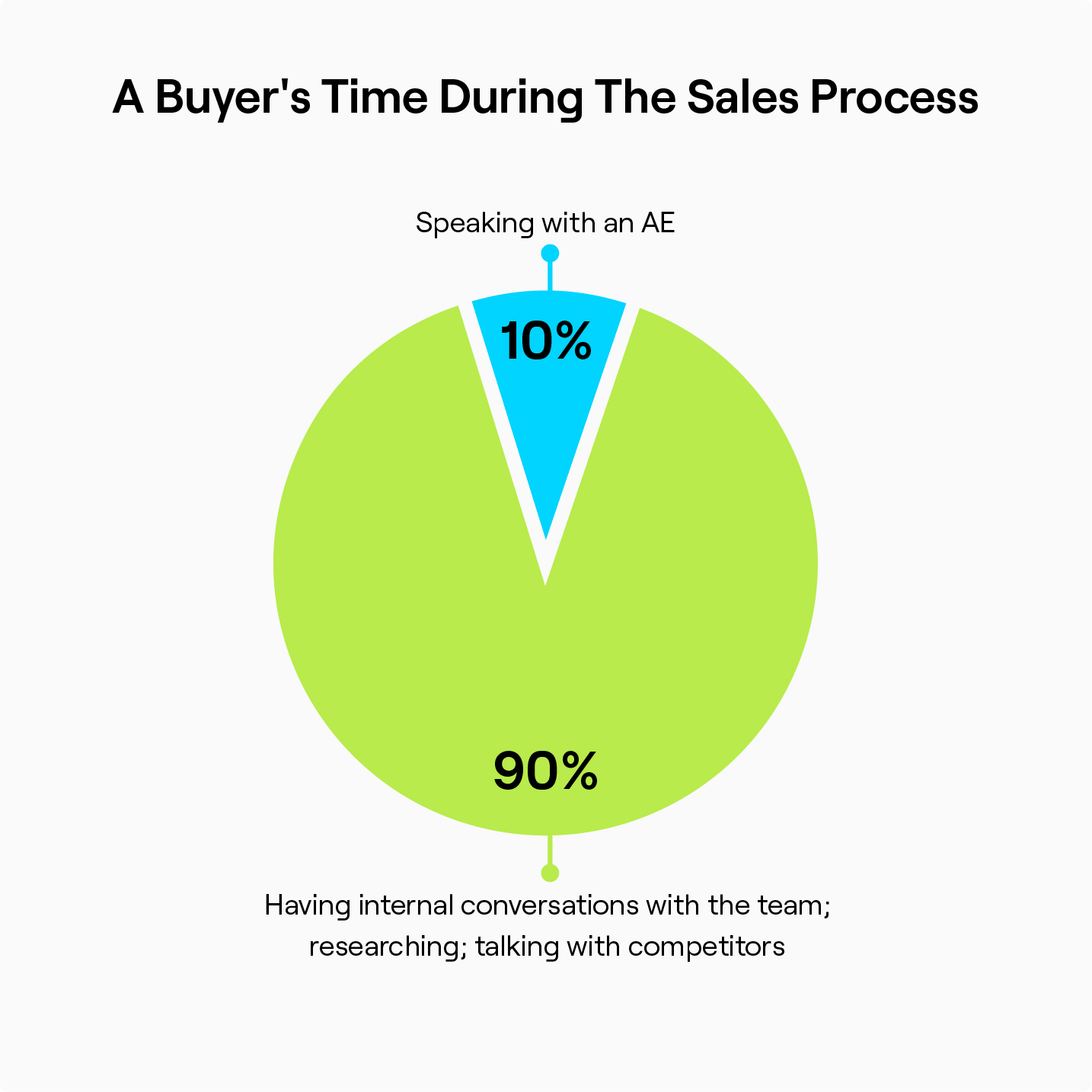

Frida added that in the actual sales cycle, very little time is spent between a buyer and an AE 👇

She added:

“This means the champion needs to be equipped to sell internally. And this is why articulating the value in a deal is really important.”

Frida also offered a word of advice when it comes to asking questions of the rep during these sessions:

“I ask the fundamentals to guide the rep, but I also try to sit on my hands a little bit. I get the rest of the team to ask questions as well.”

“That’s when these sessions are at their best, because the team gives great input and feedback that even I wouldn’t have thought of.”

Once the details of the deal have been laid out, the next part of the session focuses on…

Setting next steps

Frida said:

“The rep needs to define clear next steps. For example, let’s say we’re pushing for a sales demo. There needs to be a consideration of points such as:

- Who should we ask to attend?

- What messaging should we use to articulate the value of attending the demo?

- Do we need to send a follow-up email to get further information?”

Not only does this part of the office hour help the rep to be efficient and proactive, but it’s also helping them develop in their role. For instance, improving discovery skills.

Frida summarised the importance of these office hours:

“My hope is that the deals we’re ultimately going to lose - we lose them quicker. It’s about calling out if we don’t have a deal.”

“The trend I’ve noticed regarding rep behaviour is that less time is spent on deals that’ll close. So, these sessions help to identify red flags quicker - it saves time and creates efficiency.”

Richard Smith, EMEA VP of Sales at Allego, shared this view 👇

Later stage deal coaching

Having a centralised approach is a good way to evaluate deals in their later stages.

For Frida, this is where Gong or Salesforce is valuable, as specific data points can be analysed in weekly pipeline review sessions.

Here’s a screenshot example of how Frida has approached it with Gong 👇

Frida said:

“The deal warnings section helps managers to understand what could be potential blockers.”

“For example, communication with an important decision-maker has not been made, or it’s a deal that’s been single-threaded.”

“I also think it’s useful to look at the ACV vs sales headcount section. This is a good way to determine if there are opportunities to sell more seats.”

“We also have a notes section to help the manager and the rep to determine next steps and action items.”

The notes aim to address status updates on areas such as:

- The number of active stakeholders that have been engaged in the process

- The buying champion(s).

- The budget holder.

- The signer.

- The decision criteria.

- Teams or regions that are on a trial.

- The individuals that are on a trial.

A note on MEDDIC/MEDDPIC

In the current economic climate, buyers are far more cautious regarding purchases.

And for sellers, this means quality control when progressing deals through the pipeline.

As a reminder, here’s a snapshot of the approach behind MEDDIC/MEDDPICC👇

Gina Ruscio, our Chief of Staff, Revenue, has been responsible for rolling out MEDDPICC across the organisation.

She noted:

“Regardless of whether you’re talking about deals in the SBM or ENT segment, this framework provides a consistent language for how you talk about deals.”

For example, let’s take the champion section in the acronym.

Matt Milligan, Forbes 30 Under 30 Entrepreneur for 2021 and Co-Founder of Uhubs, believes the champion to be the most important part of the framework.

Specifically, because champions are the ones that are going to take action. So, if your rep or AE hasn’t identified the correct champion, the deal will lose momentum pretty quickly.

He explained more in his post here 👇

And if we think about sales velocity more generally, the framework is also useful for understanding that too.

Gina said:

“MEDDPICC’s big call-to-action is no one regrets qualifying out. For us at Cognism, that means trying to find the right deals so that we’re not wasting time on deals that wouldn’t be good fit accounts in the long run.”

“This ultimately helps increase our deal velocity and average contract value.”

Risky sales deals: closing thoughts

Diagnosing your deals should be treated as an ongoing activity.

Frida said:

“Regardless of how your sales team is split (by segment, region, industry or vertical), ensure each ‘sub-team’ has a weekly commit call.”

“Get the manager to have a weekly call with the rep, outlining where they’re at for the month, their commit, and their forecast. For us, this information is then tracked in a sheet, to align with deals in Salesforce or Gong.”

Now, let’s face it.

For sales teams right now, it’s far from an easy ride. And if there’s one thing you should take away from this article, it should be this:

Think about initiatives that will help you focus on attracting the right deals. Make that a core part of your playbook as a way to gain success in this market.

Ultimately, investing in deal inspection will mean that you’re 👇

- Shortening sales cycles.

- Increasing deal velocity.

- Building better quality pipeline.

- Creating predictable revenue.

Remember: be protective, productive, and efficient when it comes to your sales team’s time.

The Blueprint

This article has teased an insight into the outbound and forecasting strategies that our sales leaders have used to build our predictable revenue engine.

Check out more in Cognism’s “The Blueprint” - these same strategies enabled the team to scale from $10m to $40m ARR in just under two years 🚀

Click below 🔽

%20Campaigns%20-%20FR%20copy%202.png)