Building an effective ABM engine to target enterprise buyers

Building an effective ABM engine isn’t about running siloed campaigns—it’s about precision. By focusing on the right ICP accounts, aligning sales and marketing, and layering personalisation at scale, ABM transforms your demand engine from broad reach into targeted impact. Done well, it amplifies every campaign, accelerates enterprise deals, and drives revenue where it matters most.

Course Details:

5 lessons

70 minutes

Intermediate

Introduction: ABM basics

Account-based marketing (ABM) is a growth strategy that flips the traditional demand gen funnel on its head. Instead of casting a wide net and encouraging the right prospects to trickle through, ABM starts by identifying the specific accounts that matter most to your business and then building targeted plays to engage and convert them.

Of course, you can’t run targeted campaigns for every account. Most organisations - including us at Cognism - focus their efforts on enterprise deals, because they’re the high-ticket deals that make the increased effort more worthwhile if they convert.

At its core, ABM is driven by four main pillars. You can’t succeed by focusing on one or two in isolation; each depends on the others to deliver results.

1. Collaboration

ABM is a team sport. Success requires close alignment between Marketing, SDRs, and AEs.

If sales and marketing don’t work from the same target account list, with shared goals and feedback loops, even the best campaigns will not convert.

2. Intelligence

You can’t engage the right accounts without the right data.

Solid ICP definition, enriched account intelligence, and buying signals (e.g. intent data, technographics, job changes) are the foundation. Poor data = wasted engagement.

3. Activation

This is where your strategy comes to life. From personalised ads to curated content journeys, activation is about putting your message in front of the right people at the right time.

But without intelligence and collaboration, activation risks being scattershot.

4. Engagement

Finally, ABM is measured by how well you engage and influence target accounts. That might mean multi-threaded conversations, senior stakeholder awareness, or accelerating open opportunities. But engagement alone won’t stick if the other three pillars aren’t in place.

You can’t pick and choose. Even the most creative campaigns will fail if you’re not aligned with sales or your ICP is weak. True ABM results only come when collaboration, intelligence, activation, and engagement all work together.

Account-based marketing has become a buzzword. But ultimately, it’s ICP-driven marketing.

It’s about making sure you’re focused on the best-fit ICP accounts, the ones you know are likely to convert to revenue. Having a solid ICP will always be your foundation.

- Precision over volume → focusing on the accounts most likely to drive revenue.

- Personalisation at scale → tailoring content and outreach to each account or segment’s needs, pain points, and context.

- Sales and marketing alignment → running coordinated plays where both teams work from the same account list, intent signals, and success metrics.

Done well, ABM feels like your marketing and sales efforts were designed just for the buyer you’re engaging with.

And when combined with a modern demand gen engine, it doesn’t replace broader brand and pipeline-building efforts; it amplifies them.

Why ABM belongs at the heart of your demand engine

People perceive account-based marketing as a specialist play - something you spin up separately from the rest of your demand strategy. Too often, that disconnects it from the broader system.

But in a modern demand engine, ABM looks very different. It’s not an isolated tactic. It’s about focusing your firepower where it matters most.

ABM amplifies, not replaces, your media loops

Your content machine is already running, publishing, distributing, and compounding attention.

ABM doesn’t sit on the side of that engine. It zeroes in on the accounts and personas most likely to convert, making every blog, video, and campaign more targeted and more valuable.

It starts broad, then narrows with precision

ABM is tiered. You begin with 1:many, casting a wider net with scalable demand plays. Then, you move to 1:few, layering personalisation for priority segments.

And finally, 1:one - deep, highly tailored plays for the deals that matter most.

It’s built on a strong ICP, not assumptions

Your ICP is the foundation - get that wrong, and no amount of signals will save you. Once that’s clear, you can layer in data signals, buying triggers, and engagement metrics to prioritise the right accounts at the right time.

That way, resources stay focused on opportunities with real potential.

Sales and marketing alignment is non-negotiable.

ABM only works when both sides follow the same playbook. That means shared dashboards, visibility into intent data, and real-time feedback loops. Marketing fuels the engine with content and campaigns, and sales turns those signals into conversations and deals.

When approached this way, ABM ceases to be a siloed programme or a “quick fix” for enterprise deals.

Instead, it becomes a strategic accelerator, a way to focus your demand engine where it can generate the most impact on pipeline and revenue.

Lesson 1: Cognism’s ABM philosophy

Why this matters

Because ABM requires more effort, it can become ineffective quickly if not scaled intelligently. Many teams either go too broad, drowning reps in thousands of “priority” accounts, or too narrow, limiting impact to a handful of logos. Both approaches burn resources and stall momentum.

Cognism’s layered ABM framework solves this by creating tiers of focus. It balances reach and relevance, ensuring that every account gets the right level of attention without overwhelming sales or marketing.

The result is a scalable engine that moves accounts from awareness to engagement to pipeline without sacrificing precision.

Why bother with ABM?

A clear pattern emerged when we looked at our historic deal data:

The enterprise-level companies we won didn’t just bring in larger deal sizes; they also stuck around longer. In other words, enterprise deals mean bigger contracts and more predictable revenue streams.

The choice to move upmarket was obvious. The challenge?

Getting in front of those accounts in the first place. Enterprise buyers are some of the most sought-after in B2B. On average, they’re targeted nearly twice as often as SMBs, which means standing out and creating meaningful engagement is no easy task.

That’s where ABM comes in. Instead of spreading efforts thin, it allows us to focus resources on the accounts that matter most, with strategies designed to cut through the noise.

Since shifting our focus to enterprise, we’ve built a dedicated ABM approach that’s evolved significantly in just over a year or two.

And true to Cognism’s ethos, we’re not standing still. We’re constantly refining how sales and marketing work together, layering in new signals, and testing fresh tactics to keep improving how we win - and keep - enterprise customers.

Cognism’s approach to layered ABM

The way we move our target accounts in and out of 1:many, 1:few and 1:one is constantly evolving. Our most recent iteration looks like this:

In ABM, we operate on three levels:

- 1:many → Broad awareness across ICP-fit accounts.

- 1:few → Narrower plays focused on in-market cohorts.

- 1:one → Deep, personalised engagement for live opportunities.

Think of these as layers of focus. Accounts move between them based on fit, intent, and engagement signals.

The best way to think about it: an artificial funnel designed to move ICP accounts from out-of-market → to pipeline → to revenue.

1:many ABM

1:many is the broadest of the three ABM campaign types. It’s designed to reach defined ICP accounts across verticals or territories (e.g., SaaS, supply chain, financial services).

At this stage, it’s all about awareness and air cover for sales. The goal is to improve engagement and brand recognition within ICP accounts, so that when they move in-market, Cognism is already front of their minds.

Campaigns are thematic rather than hyper-personalised. Visibility and salience matter more than one-to-one relevance. Lists are broad - but still intentionally built - to ensure outreach remains targeted.

We tier accounts to sharpen focus:

- High-priority → already engaging or showing intent signals.

- Mid-priority → awareness-focused, building recognition until they’re ready to engage further.

This layer amplifies our media loops, fuelling paid, organic, and content channels with a scalable but targeted approach.

1:few ABM

We narrow our focus once stronger buying signals appear within a cluster of accounts. The audience size shrinks, and the messaging sharpens.

This deployment model is about identifying which accounts are truly in-market so we can convert them. That’s not easy, which is why intelligence is critical.

The more signals you can layer in, the more confidence you’ll have in prioritising the right accounts.

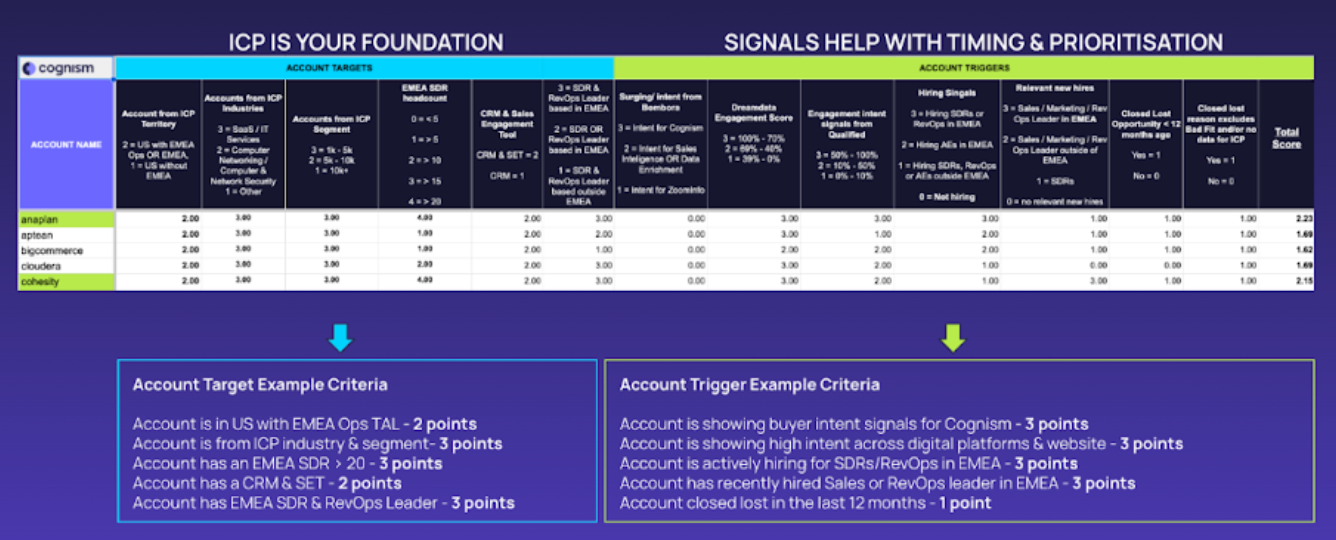

At Cognism, we call this approach signal stacking: combining multiple indicators such as intent data, job join growth, hiring patterns (e.g., new EMEA SDR teams), website engagement, and competitor renewal cycles.

Together, they give us a clear picture of which accounts are ready to move.

Campaigns are built for smaller cohorts with shared traits, such as competitor tech users or industry-specific sub-groups. Content becomes more tailored, incorporating case studies, competitor comparisons, or vertical-specific proof points.

Sales and marketing run tightly coordinated plays here, syncing outreach with campaign moments like events, content launches, or outbound pushes. The aim is to shift accounts from passive awareness to active engagement, laying the groundwork for pipeline creation.

1:one ABM

For top-tier, high-intent accounts with the greatest revenue potential, we double down with deal-based ABM.

These are high-value opportunities where the ACV justifies significant investment, and the goal is to multi-thread the buying committee and influence the deal to closed-won.

At this stage, scale takes a back seat to precision and impact. We build our campaigns around deeply personalised, high-touch experiences that show the account they’re a true priority:

- Custom digital assets → tailored microsites, bespoke landing pages, or demo environments built specifically for the buying committee.

- Offline experiences → curated dinners, roundtables, or executive events designed to build trust and accelerate velocity.

- Signal-led outreach → messaging mapped to the account’s specific behaviours, triggers, or pain points across the buying group.

The aim is not just to generate engagement, but to orchestrate influence across the full buying committee. By engaging stakeholders with precision content and experiences that reflect their context, we increase the likelihood of deal progression and successful close.

When layered with 1:many and 1:few ABM, this approach ensures each account receives the right level of focus at the right time, based on clear engagement signals. That’s how we turn ABM from isolated campaigns into a scalable engine for pipeline and revenue.

Target full buying committees

One person never decides enterprise deals. They’re shaped by buying committees, groups of 6–10 stakeholders across functions, each with their own priorities, objections, and influence on the purchase. We’ve learned that ignoring even one voice risks slowing or stalling a deal.

That’s why we built our 1:one ABM plays to map, engage, and win over the full committee, not just a single champion:

Identify the players

Working with SDR and AE pairings, we map champions, decision-makers, blockers, and influencers.

This allows us to design activation moments and choose the right channels for each persona (see graphic).

Tailor the narrative

Each persona needs a story that connects to their goals. A RevOps leader cares about clean data and integrations, while a CMO looks at growth efficiency.

Our campaigns deliver tailored messaging to every stakeholder, ensuring relevance across the committee.

Create surround sound

Committees don’t all engage on the same channel.

That’s why we orchestrate multi-channel messaging - LinkedIn, email, direct mail, events, webinars, sales outreach - so the whole group sees and feels Cognism’s value from multiple touchpoints.

Enable multi-threading for sales

Reps are equipped to go beyond one champion.

With tailored assets and plays, they connect with multiple stakeholders in the account, building influence across the committee rather than relying on a single contact.

In enterprise, you’ll never reach everyone effectively on one channel. You have to adapt to how each stakeholder prefers to engage.

On top of that, with more companies adopting ABM, competition for attention is intense. Simply running LinkedIn ads and hosting events won’t be enough to cut through.

That’s why we map sub-personas and seniority to the channels they’re most likely to respond to:

- Decision-makers → high-touch tactics like direct mail and curated networking events.

- Individual contributors → scalable plays like our virtual Cold Calling webinar series.

- Wider account penetration → broad-reach tactics like LinkedIn ads, landing pages, and content hubs.

By layering these plays, we achieve true surround sound. Each stakeholder sees Cognism’s value in a way that resonates with their role, and together, this builds the momentum needed to move high-value enterprise deals to closed-won.

The goal in 1:one ABM isn’t just to win a deal, it’s to build broad, multi-stakeholder confidence that choosing Cognism is the low-risk, high-value decision.

Course homework

To put this lesson into practice, choose at least one of the following exercises:

1. Tier your target accounts

- Take your current target account list and break it down into 1:many, 1:few, and 1:one tiers.

- 1:many → Which ICP accounts (industries, company sizes, personas, territories) drive the bulk of your revenue historically? These belong in broad awareness campaigns.

- 1:few → Which of those ICP accounts are showing intent through signal stacking (e.g. job join growth, hiring SDRs, website engagement, intent data, competitor renewals)? These are your in-market plays.

- 1:one → Which high-value opportunities are already in pipeline and justify high-touch, high-lift personalised experiences?

- Write a short explanation for why you placed accounts in each tier.

2. Buying committee mapping

- Pick one 1:one account in pipeline. Map out the potential buying committee: economic buyers, champions, influencers, and blockers.

- For each persona, note the outcomes they care most about (e.g. RevOps → clean data and integration, CMO → growth efficiency, SDR manager → easier prospecting).

- Align channels and tactics to each persona. For example:

- Decision-makers → direct mail or curated dinners.

- Individual contributors → webinars or hands-on demos.

- Wider account → LinkedIn ads and landing pages.

- Draft one personalised narrative or message per role, showing how you would engage them.

3. Signal check

- Review how you currently spot “hot” accounts.

- Which engagement signals do you already track? (e.g. website visits, content engagement, event attendance, intent data).

- Which are missing that could help you prioritise better? (e.g. competitor contract renewals, hiring trends, job join growth).

- Identify one new signal you could start tracking this quarter. Explain how it would change your account tiering and the plays you run.

Lesson 2: Account selection and prioritisation

Why this matters

ABM lives or dies on account selection.

You can have the sharpest creative, the best orchestration, and the most advanced tech stack, but if you’re pointing it all at the wrong accounts, the strategy collapses before it begins.

That’s why we don’t treat account selection as a “wish list exercise.” Instead, we use discipline at each stage of the ABM deployment model:

1:many – ICP-driven targeting

At the broadest stage, everything starts with your ideal customer profile. We analyse closed-won revenue to identify the industries, company sizes, personas, and territories that deliver the most value.

This ensures we focus our 1:Many campaigns on the right foundation: ICP accounts most likely to convert in the long term.

1:Few – Signal stacking to spot in-market accounts

From that ICP pool, we identify which accounts are in-market using a signal stacking approach. The more signals we layer in, the more confident we are in prioritisation.

These signals include intent data, job join growth, SDR hiring, website engagement, competitor renewals, and even patterns like closed-lost opportunities that later convert.

1:Few is where we narrow focus to convert the 5% who are ready now.

1:One – Deal-based, high-value opportunities

At this stage, it’s about precision. We double down on high-value opportunities already in pipeline.

These are large ACV accounts where multi-threading the buying committee with high-touch, personalised plays (microsites, tailored demos, curated dinners, direct mail) makes the difference.

Here, ABM is deal-based: influencing the full committee to accelerate velocity and win.

How we approach account selection

We treat account selection and prioritisation as a layered, dynamic process, not a one-off list-building exercise.

The goal is to keep our ABM engine focused on the accounts that matter most right now, while avoiding the bloat and inertia that slow so many programs down.

1:many account selection – building the foundation

Everything starts with the ideal customer profile (ICP). We analyse closed-won revenue to identify the attributes of our best-fit accounts:

- Which regions, industries, and company sizes deliver the most value?

- Does SDR headcount correlate with conversion?

- Are they typically above a certain revenue threshold?

- How many closed-lost attempts did it take before they became a customer?

- Do they already invest in outbound tools, have a RevOps function, or operate in markets where compliant data is critical?

This gives us a lookalike model of companies most likely to succeed with Cognism. The 1:Many list is deliberately broad but disciplined — the foundation that fuels the rest of the funnel.

1:few account selection – surfacing in-market cohorts

From that ICP pool, we then identify which accounts are in-market right now. This is where we use signal stacking — layering multiple triggers to build confidence in prioritisation.

- Intent data: Are they researching our category?

- Engagement: Have they interacted with our content, ads, or events?

- Hiring triggers: Are they expanding SDR or RevOps teams?

- Job join growth: Have new decision-makers entered the business?

- Competitor renewals: Are they approaching contract end?

We pull accounts showing multiple signals into 1:Few campaigns, where messaging becomes sharper and conversion-focused.

1:One account selection – converting opportunities

The final stage is doubling down on high-value opportunities already in pipeline.

Here ABM becomes deal-based: we use high-touch, high-lift plays to accelerate opportunities and influence the full buying committee. We ask questions like:

- Do we have a strong use case (e.g. EMEA data coverage)?

- Do we have a strong champion driving the deal internally?

- Is the deal above our Enterprise ACV threshold?

If the answer is yes, these accounts receive the highest level of personalisation: tailored microsites, custom demos, curated events, or direct mail — tactics designed to multi-thread and build momentum to closed-won.

The bigger picture

ABM is about moving a defined set of ICP accounts through an artificial funnel: from unaware to engaged, to pipeline, and finally to revenue.

By anchoring every campaign in ICP fit, layering intent and engagement signals, and escalating the right opportunities into 1:One plays, Cognism keeps its ABM engine focused on real opportunities, not static wish lists or vanity targets.

When account selection and prioritisation are done well, three things happen:

- Sales focus sharpens → reps spend time on accounts most likely to convert, not just the loudest or biggest names.

- Marketing efforts compound → campaigns are more efficient because they target accounts with real potential.

- Pipeline quality improves → deals are better aligned to our product’s value, shortening cycles and increasing win rates.

The result is ABM that feels less like spraying campaigns at logos and more like orchestrating a targeted, signal-led path to revenue.

Course homework:

To put this lesson into practice, choose at least one of the following exercises:

1. ICP fit vs. Intent reality check

- Take your current target account list.

- For each account, check:

- Does it fit your ICP?

- Is there evidence of intent (e.g., research activity, intent data spikes)?

- Is there engagement (e.g., repeat content views, event attendance)?

- Sort accounts into a 3x3 grid (ICP Fit / Intent / Engagement).

- Highlight 3 accounts that are strong across all three factors and 3 that are weak.

Write down how you’d adjust focus accordingly.

2. Dynamic list refresh

- Look at your ABM list from 3 months ago (or imagine one).

- Which accounts would you move up in priority based on recent activity?

- Which would you move down because their signals have gone cold?

Document how often you think your account list should be refreshed (monthly, quarterly, weekly?) and why.

- Choose one of your ICP-fit accounts that hasn’t engaged yet.

- Brainstorm 3–5 possible signals that would tell you they’re moving closer to being in-market (e.g., hiring SDRs, launching in a new region, engaging with data compliance content).

- Where could you realistically find those signals (intent provider, LinkedIn, sales intel, website tracking)?

Lesson 3: Driving sales and marketing alignment

Why this matters

If sales and marketing don’t agree on who the target accounts are, what signals matter, and how success is measured, ABM breaks down fast.

People often talk about alignment as if it’s just sitting down once a quarter to agree on a list of accounts. But it goes much deeper in practice, starting with how those lists are built.

Building an ABM account list is part data analysis and part qualitative insight:

Marketing brings the quantitative view: closed-won revenue analysis, ICP attributes, and intent data. Sales bring the on-the-ground knowledge: which accounts are in active cycles, where relationships exist, and which logos would carry strategic weight.

You need both perspectives to build a list that’s not only data-driven but also validated in the field.

That’s what creates confidence. Sales need to feel that the list is fit for purpose and that if they put their time into these accounts, marketing is backing them with the right air cover and plays.

When both teams are aligned this way, working from the same dashboards and data, reacting to the same real-time signals, and owning the same revenue outcomes, ABM stops being “a marketing campaign” and becomes a joint go-to-market strategy.

Marketing fuels awareness and engagement at scale. Sales accelerates deals with tailored, context-rich outreach. And buyers feel a consistent, joined-up experience across every touchpoint.

Educating your sales team

The single biggest driver of sales and marketing alignment in ABM is education.

Too often, ABM fails not because the strategy is wrong, but because there isn’t a shared understanding of what it actually means.

A recent ForgeX ABM report found that the two biggest barriers to implementation are:

- A lack of internal understanding of the different ABM deployment models (1:many, 1:few, 1:one).

- A lack of alignment on the definition of ABM itself.

That rings true. If sales sees ABM as just another marketing campaign, or worse, a distraction from their pipeline targets, buy-in collapses before the program even starts.

At the start of the year, we used our Sales Kick-Off as a platform to run a dedicated ABM education session. The goal was to show the sales team three things:

- What ABM means to us → our definition, the deployment models we use, and why it matters.

- How we’re going to execute → the strategy, the signals, and the plays behind the program.

- Why it helps them → most importantly, how ABM supports reps in closing more revenue by focusing energy on the right accounts, building stronger engagement, and accelerating deals.

This wasn’t about high-level theory but about showing sales the practical impact. Buy-in becomes natural when they see that ABM helps them build multi-threaded relationships, gives them air cover in key accounts, and removes wasted effort on poor-fit leads.

How to stay aligned with sales

Alignment isn’t a quarterly workshop. It’s baked into our daily operating rhythm.

We start with account selection. Sales and marketing co-build account lists, combining ICP fit with intent data and engagement signals.

These lists are dynamic. Accounts move in and out depending on real-time activity, so both teams stay focused on where there’s genuine buying potential, not outdated assumptions.

Here’s what the process looks like:

- Monthly → 1:many reviews: Marketing shares the broad ICP account list mapped with engagement scores. This helps sales prioritise the warmest accounts for always-on outbound, while marketing continues to serve ads and nurture content into the same audience.

- Bi-weekly → 1:few reviews: We sit down with sales to review the high-priority in-market accounts rolled into 1:Few programs. Together, we assess penetration inside those accounts, decide which to drop, add, and double down on. Marketing brings insights from signals and campaigns, while sales shares qualitative intel from conversations on the ground.

Signals are then shared in real time. Sales sees the same intelligence marketing uses - surges of traffic to product pages, repeat ad engagements, webinar attendance, or content downloads.

This lets reps prioritise the accounts showing the strongest intent, not just the loudest noise. It builds confidence that they’re spending time where it matters most.

Reporting is unified, too. Instead of operating from different data sets, both teams rely on one system of record.

Dashboards surface leading indicators (new contacts from target accounts, repeat engagement, buying group growth) and lagging ones (pipeline and revenue impact). This dual focus means we can measure progress before deals close, while still tying ABM to revenue.

Finally, feedback loops close the gap between strategy and execution. Those bi-weekly syncs aren’t just for reporting back, they’re for collaboration. Sales shares what’s resonating, the objections they’re facing, and which content lands best.

Marketing uses this live intelligence to adjust messaging, refine targeting, and develop new assets that map to real buyer conversations.

And a final critical piece:

Finding champion AE and SDR pairings. ABM success doesn’t show overnight, so it’s vital to create pockets of proof early on. When a rep pairing sees tangible wins from the program, their positivity and results become contagious: “Oh, it’s working for them - I want some of that.”

Getting those champions on board quickly builds momentum and helps spread buy-in across the wider sales team.

The impact of alignment

When alignment works, the impact is clear across every part of the go-to-market engine. The first and most obvious outcome is consistent ICP focus.

With sales and marketing building and refining target lists together, you avoid wasted spend on irrelevant accounts.

Every campaign, piece of content, and outreach sequence is directed towards companies that fit the profile, meaning effort compounds rather than being diluted across the wrong audiences.

The second benefit is faster sales cycles. When marketing has already primed accounts with tailored messaging, relevant content, and credibility signals, buyers don’t feel like strangers when they finally speak to a rep.

They already recognise your brand, understand your value, and feel “known.” That familiarity shortens discovery, builds trust earlier, and accelerates the path to revenue.

Alignment also drives joint accountability. Instead of marketing being measured purely on leads and sales being measured purely on closed revenue, both teams share ownership of pipeline creation and progression.

This eliminates the finger-pointing that often occurs when numbers slip and replaces it with collaboration around a shared target.

Finally, clearer reporting transforms how we evaluate performance. With both teams working from the same dashboards, disputes about attribution or what “counts” as success disappear.

Leadership gets a unified view of how ABM contributes to pipeline and revenue, while sales and marketing gain confidence that their collective efforts are being measured fairly.

The result is an ABM function that is aligned not only in theory but also in daily practice, delivering tighter targeting, faster cycles, stronger accountability, and more transparent reporting.

Signs alignment is working

You can tell when sales and marketing alignment is more than just a slogan because it’s evident in how the business operates daily.

The first signal is a consistent ICP focus. There’s no rogue targeting and no wasted budget chasing accounts that don’t fit.

Instead, every campaign and every outreach sequence is tightly mapped to the agreed-upon account list, giving both teams confidence that effort is compounding in the right places.

Another clear sign is sales adoption. When alignment is strong, reps don’t just tolerate the dashboards, playbooks, and outreach assets marketing provides; they actively use them.

That’s because they see value:

The insights are relevant, the messaging resonates, and the materials make their job easier. Adoption is proof that marketing is fuelling sales activity rather than creating assets in a vacuum.

Revenue accountability is another marker. In an aligned system, pipeline creation is a joint responsibility.

Marketing isn’t left holding the MQL bag while sales is measured only on closed revenue. Instead, both teams share ownership of driving deals into and through the pipeline. That shared accountability changes behaviours, ensuring collaboration across the entire buyer journey.

Finally, you’ll notice deals moving faster. Prospects in ABM cohorts feel “known” from the very first touch. By the time they speak to a rep, they’ve already engaged with targeted campaigns, relevant content, and messaging that reflects their world. This familiarity accelerates trust and shortens sales cycles, a tangible sign that alignment is paying off.

When these signs are present, alignment ceases to be a goal in itself and becomes a competitive advantage, powering both efficiency and growth.

Course homework

To put this lesson into practice, choose at least one of the following exercises:

1. ABM education workshop

Run a short workshop to educate your sales team on ABM. Your goal is to build shared understanding and buy-in.

- Start by defining what ABM means in your organisation and walk through the three deployment models (1:many, 1:few, 1:one).

- Explain how ABM supports sales, from creating awareness and air cover, to surfacing in-market accounts, to accelerating high-value deals.

- Share one concrete example of how ABM has already helped (or could help) close revenue.

- Ask the sales team what success looks like for them, and where they see opportunities for ABM to make their lives easier.

2. Shared dashboard audit

Look at the dashboards your sales and marketing teams use.

- Are you looking at the same metrics?

- Which are leading indicators (early engagement, new contacts, surging intent)?

- Which are lagging indicators (pipeline created, deals won)?

Identify one gap in your reporting where sales and marketing could benefit from shared visibility, and suggest a fix.

3. Feedback loop simulation

Create a mini feedback loop exercise:

- Imagine a sales rep tells you a new objection they’re hearing in discovery calls.

- Draft how marketing would respond: what asset, messaging, or campaign tweak could you make within two weeks to support them?

- Then flip it: imagine marketing launches a new campaign. What’s one way sales could feed back fast on whether it’s landing with prospects?

Guest Lecture: How to operationalise your ABM with Corrina Owens

Corrina Owens

Fractional ABM @ TripleLift

Corrina Owens is a seasoned B2B marketing leader with deep expertise in ABM, growth, and community-driven outreach. She’s built her reputation through consistently high-impact LinkedIn content and working with SaaS brands to formalise evangelist roles that bridge marketing, positioning, and customer advocacy. Corrina’s approach blends creative storytelling with data-driven rigor, making her a sought-after voice in how modern brands build influence and engagement at scale.

There are countless interpretations of ABM. Ask five people in the same company what it means, and you’ll often get five different answers. That misalignment isn’t a coincidence, and It usually stems from the fact that the operating model is missing.

Without a clear framework, sales and marketing approach ABM from different angles, and everyone ends up reading from a different page of the playbook.

In my experience, people tend to fall into the trap of treating ABM as a campaign. But I find that to massively underestimate what it takes to do ABM well.

It’s not a set of fancy ads, one-off plays, or a quarterly initiative. Instead, ABM is a go-to-market operating model. It’s the structure that dictates how marketing and sales run together. How they share planning, how they commit to accounts, and how they align on outcomes.

When ABM is treated this way, the focus shifts. It stops being about leads and vanity metrics, and starts being about what really matters: pipeline creation, deal progression, and sales velocity. That’s when ABM becomes a growth engine, not a side project.

In this lesson, I’m going to share how I would go about operationalising ABM if I were to be starting from scratch all over again.

1) Start where sales starts: joint account selection

The best time to launch or refresh an ABM program is during the annual book build. This is the moment when sales leadership is mapping territories, setting quotas, and deciding which accounts will be prioritised for the year ahead. Marketing can either sit on the sidelines and wait for the outcome, or step in as a true partner.

This is where marketing shows up with a data hat on. Before sales finalises their books, bring forward a closed-won and closed-lost analysis of the last twelve months. Don’t just present the numbers, dig into the patterns.

Which industries consistently generated the most wins? Which deal sizes moved with the best velocity? Which entry personas tended to spark multi-threaded conversations that pulled in a full buying group? And what were the most common paths for how customers first discovered your company?

This exercise is more than just validation. In my experience, it nearly always reveals something new. Every company has a “folklore ICP”, an assumed definition of the ideal customer profile.

But when you look at the hard data, there’s often a surprise: a vertical you hadn’t prioritised, a persona you hadn’t considered central, or a deal profile that delivers outsized ROI. These insights give both sales and marketing a firmer foundation for account selection.

Once the analysis is on the table, the next step is co-signing the target list with sales. This act of jointly committing to the same accounts eliminates one of the biggest pitfalls in ABM.

Marketing can no longer claim, “sales gave us the wrong accounts,” and sales can’t complain that “marketing targeted the wrong list.” Both sides are invested, both share responsibility, and both measure success against the same outcomes.

2) Codify the handoff: a simple (but effective) Sales↔Marketing SLA

ABM cannot run in a vacuum. To avoid misalignment, put the rules in writing so that execution becomes predictable - even boring, in the best way. This is where a Sales ↔ Marketing Service Level Agreement (SLA) comes in (click to download here!).

First, agree on definitions. Clearly spell out what qualifies as a target account, an engaged account, and a sales-ready account at the buying group level. This removes ambiguity and ensures both teams are working to the same criteria.

Next, define routing and response. Who owns what type of account or signal? How quickly should they act? And in which system is this tracked? Setting SLAs on response times keeps momentum and avoids accounts going cold.

Build in a feedback loop. A short, weekly 15-minute standup between sales and marketing creates space to review account movement, objections, disqualification reasons, and any gaps in messaging or content. Updating the playbook continuously prevents the program from going stale.

Finally, align on measurement. Success should be shared across business outcomes that matter, like opportunity creation, opportunity velocity, and influenced revenue by tier. Both sales and marketing co-own these outcomes, reinforcing the principle that ABM is a joint operating model, not a marketing side project.

When codified properly, an SLA transforms the handoff from a point of friction into a seamless process that both teams trust.

3) Fewer signals, stronger plays

It’s tempting to track every buying signal available - from page visits to G2 reviews to third-party intent data.

But in practice, I’ve found that realistically, it comes down to one or two signals that consistently correlate with real opportunity creation. Rather than boiling the ocean, I’d recommend designing plays around the strongest signals you can prove.

Playbook A - Competitor-switch heat

One of the clearest signals is a spike in competitor activity - whether that’s keyword searches or visits to competitive landing pages.

When this happens, marketing can surround the account with a customer story that directly addresses the risks of switching. Sales then follows up with a focused two-step outreach from the AE and SE: “Here’s what teams like yours got wrong about switching, and how they avoided it.”

Success here can be measured by how many meetings and sales-qualified opportunities are created within 21 days of the trigger.

Playbook B - Buying-group activation

Another powerful signal is when two or more personas from the same account engage within a short timeframe - for example, a business team manager and leader from finance.

Marketing’s role can look like surrounding the account with persona-specific nurture content (business outcomes for one audience, ROI and risk reduction for the other) and a short “consensus brief” that helps both sides align.

Sales can then multi-threads the account, mapping roles, assigning next steps, and pushing toward a consensus call rather than a generic demo. The key metric here is stage advancement speed (opportunity velocity) compared to baseline.

By focusing on a small number of validated signals and building coordinated plays around them, you give your ABM program sharper precision and avoid spreading resources across noise that doesn’t move the needle.

4) What I’d measure (and why)

For me, the measure of ABM success in B2B SaaS should always correlate to business impact: opportunity creation and velocity within your target account tiers. If accounts are progressing faster through the funnel and new opportunities are consistently being created in the right segments, this indicates that your program (and target account selection) is firing on all cylinders

But numbers only tell part of the story. I also place a lot of weight on qualitative signals you’re receiving from the sales side of the house:

Are we consistently getting into the right rooms? Are buyers repeating our narrative back to us in their own words? Are the objections we hear shifting over time? These cues reveal whether our message is landing with the people who actually influence deals.

It’s important to remember that ads, content, and events aren’t the “results” of ABM - they’re the inputs. They serve the operating model, not the other way around. If the plays are working, they should create momentum inside target accounts that sales can feel, pipeline can track, and leadership can recognise.

That’s why I keep measurement focused on account movement and sales feedback. Because at the end of the day, ABM isn’t about proving marketing activity - it’s about proving revenue impact.

Lesson 4: Executing ABM with a demand generation lens

Why this matters

By now, you know how we define and select accounts at each tier (1:many, 1:few, 1:one). This lesson focuses on the what:

What does execution look like in practice once you’ve prioritised accounts?

At Cognism, we don’t run ABM as a silo; we run it as targeted demand gen. The plays are the same (brand, content, paid, events, sales enablement), but we deploy them more precisely based on ICP fit, signals, and buying stage.

In practice, that means following six core steps that turn strategy into execution.

How Cognism targets enterprise accounts with ABM: 6 steps

Now that we’ve defined the different types of ABM, let’s break down how Cognism runs enterprise ABM in practice.

1. Define your ICP (the 1:many list)

Start with your ICP.

This becomes your 1:many account list, the “outbound-worthy” accounts that sales can prospect into and marketing can support at scale through LinkedIn ads, nurture emails, and other broad plays.

Think of it as the foundation: the full set of companies most likely to benefit from your solution.

2. Identify high-priority accounts (the 1:few cohort)

From the ICP list, narrow in on the accounts that show signs of being in-market.

This is where the signal stacking approach comes in, combining intent, engagement, competitor renewals, closed-lost reactivations, job join growth, and other triggers.

The goal is to surface a smaller, higher-potential cohort that sales can prioritise more deeply. At the same time, marketing expands the channel mix with more tailored campaigns (gifting, trigger-based LinkedIn ads, targeted emails).

3. Bucket accounts by signal (dynamic targeting)

Once identified, we bucket the accounts by the signals they show. This keeps sales and marketing aligned on which accounts to focus on, and allows both teams to tailor outreach by signal.

Marketing builds specific nurtures around each trigger, while sales personalises outreach with the same context.

This process is dynamic; we refresh it monthly. Each month, new accounts and contacts are pushed to sales alongside the matching nurture streams, ensuring effort always maps to the freshest signals.

4. Map marketing touchpoints

This is where the demand gen lens comes in. We map how we’ll engage each priority account across content and channels.

- Content mapping: Do we need new, persona-specific content? Which existing assets are performing best?

- Channel mapping: What’s the best way to reach them? Options include LinkedIn, targeted ads, 1:1 training offers, Reachdesk gifts, bespoke sequences, or cold-calling competitions.

- Activation planning: We plan campaigns in Asana with deadlines, goals, and tracking metrics. Weekly optimisation and monthly reporting keep everything moving.

To stay aligned, marketing and sales hold bi-weekly check-ins at the territory level, ensuring both teams work from live engagement signals.

5. Equip sales with assets

ABM execution isn’t just about marketing plays - it’s about orchestration.

That means equipping sales with personalised content and messaging so they can pick up seamlessly where campaigns leave off.

Marketing provides:

- Account research and briefing docs.

- Personalised sequences.

- Content for digital sales rooms.

Sales provides back:

- Personalised demo videos.

- Live feedback from conversations.

- In some cases, looping in CSMs to build early use-case credibility.

The goal is to create a single, consistent narrative across every touchpoint.

6. Track, learn, and optimise

Finally, measurement. At Cognism, we don’t track ABM by MQLs. Instead, we focus on leading and lagging indicators that reflect real buying momentum.

- Leading indicators: surging intent scores, number of active personas, repeat BOFU visits, % of account penetrated.

- Lagging indicators: SQOs, pipeline generated, ARR closed.

This approach quickly tells us whether we’re engaging the right accounts in the right way. If deals aren’t moving, it’s not a guessing game - we revisit ICP, signals, and touchpoints to refine.

ABM in practice

Whether you’re running 1:many, 1:few or 1:one, here are some of our ABM tactics and approaches that we like to use ourselves:

Personalised microsites

When a high-intent account makes it onto our 1:one list, we build them a dedicated microsite. These aren’t generic landing pages - we design them to speak directly to that company.

At the top, we call them out by name and reference the challenges we know they face. The headline usually makes it clear:

“We built this page to show how Cognism can help [Company Name] generate pipeline and drive revenue - faster.”

From there, we layer in proof: a custom demo video filmed for that account, pain points that match their situation, and social proof from companies just like them.

The results? Engagement well above benchmark:

- 5.6 minutes average time on page.

- 70+ visits from one target account in a few months.

- 150+ demo interactions from a single microsite.

This proves that personalised microsites get more attention.

Email nurtures

The microsites only work if people see them, so we back them up with email nurture sequences built for 1:one and 1:few.

Instead of leaving reps to send generic outreach, we equip them with templates designed to add value:

Pointing prospects to tailored microsites, surfacing relevant insights, and connecting the message back to their role or situation.

This links directly to our “bucket accounts by signal” process. Each signal triggers a specific nurture path:

- Job joiners → new decision-makers or influencers entering target accounts are automatically enrolled in a job join nurture. These sequences welcome them into their role with insights, playbooks, or benchmarking content, while positioning Cognism as a strategic partner from day one.

- High intent + high engagement accounts → when accounts light up across multiple signals, we push them into a bottom-of-funnel nurture. These emails highlight proof points like Date-a-vendor assets, case studies, and product deep dives to accelerate deal progression.

- Competitor renewals / closed-lost reactivations → targeted nurtures address the specific pain points that drove the previous choice, paired with assets showing why Cognism is the safer, more compliant alternative.

The results speak for themselves:

These nurtures consistently outperform standard rep sends in both open and engagement rates.

It’s a win-win: reps feel more confident in their outreach, and buyers feel like we actually understand their context.

Gifting

We send the marketing leaders in high-priority in-market accounts a free copy of Alice’s CMO diary.

Marketing personas are hugely influential in our deals (budget holders or will always have a say in evaluations), so this is a nice touch to gain their attention when it comes to marketing getting involved in the deal.

Targeted paid ads

Paid is often seen as too broad for ABM, but at the 1:one level, it becomes a precision tool.

We build ads informed by Gong call notes, website behaviour, and past engagement to reflect the exact challenges an account is facing.

A few of the tactics we use:

- Embedding social proof tailored to the account’s use case.

- Featuring the assigned AE’s face in the ad — this is especially powerful if they’ve spoken before.

- Creating multi-department ads, targeting marketing and sales if the need spans multiple teams.

The metrics back it up:

- Dwell time of 5.2s vs 3.7s on standard ads.

- CTR of 1.45% vs 0.82% on always-on.

In other words: more eyes, more clicks, more meaningful engagement.

Out-of-home advertising

Out-of-home is one of the most overlooked ABM channels. Our future plans involve mixing OOH ads with digital channels to break through the noise.

This strategy involves placing ads in the elevators of target account offices as the first touchpoint, directing employees via QR code to a personalised landing page.

Users’ web visits will then trigger Uber Eats vouchers for employees to ‘grab lunch on us’, while personalised remarketing ads encouraged further interaction for employees not in the office.

Bespoke dinners and in-person plays

Enterprise ABM isn’t all digital.

Sometimes the most effective way to accelerate a relationship is face-to-face. We’ve leaned into exclusive dinners with decision-makers from target accounts, often co-hosted with partners like Gong or LeanData.

The results have been immediate:

- At Forrester, our dinner directly contributed to a $75k opportunity.

- At SaaStr, a co-hosted dinner sparked six new enterprise conversations.

We also experiment with more unconventional offline plays, from branded office ads (think lift screens) to lunch-and-learn sessions where SDRs can get hands-on with our platform.

These touches make Cognism feel human - not just another vendor on LinkedIn.

At the 1:One level, ABM isn’t about “spray and pray” campaigns. It’s about proving to a single account that you understand them better than anyone else in the market.

We create multiple entry points into the buying committee by combining custom-built experiences (like microsites, curated dinners, tailored demos) with personalised amplification (ads, email nurtures, direct mail). And because signals and intent data underpin every play, we only go this deep when we know an account is worth it.

But here’s the catch:

ABM isn’t just about targeting the right accounts. It’s about targeting the right contacts inside those accounts. That’s where data becomes the difference-maker.

When you have accurate, compliant contact data, the channel mix expands dramatically:

- LinkedIn campaigns that land directly with verified buying committee members.

- Dinner or roundtable invites sent to the right VPs and Directors.

- Personalised gifting or webinar campaigns powered by accurate emails.

- Office-based ads that align with HQ locations.

The richer the contact-level data, the more touchpoints you can orchestrate, and the harder it is for competitors to displace you.

That’s what makes 1:One ABM a true revenue driver:

The combination of deep personalisation, multi-channel execution, and data precision ensures every play reaches the right people at the right time.

Course homework

1. ABM account plan starter

- Select one “hot” account.

- Answer the following:

- Have you spoken to them before? If yes, what happened?

- What content or pages are they engaging with?

- Which personas are most active, and what role do they play in the buying committee?

- What triggers (e.g., new hiring, tool adoption) suggest they’re moving towards a decision?

Based on your answers, write a 3–5 sentence mini account plan outlining how you’d prioritise and approach them.

2. Microsite concept brief

- Imagine one of your priority accounts has made it onto your 1:one ABM list.

- Draft a basic microsite outline, including:

- A headline that calls out their company by name.

- 2–3 proof points or case studies you would feature.

- One custom demo or piece of content you’d include.

Keep it short - the aim is to translate the concept into something actionable.

3. Signal-led optimisation review

- Look at an ABM campaign you’ve run recently (or imagine one if you don’t have an example).

- What leading indicators did you track (e.g., number of active personas, repeat BOFU visits)?

- Did those signals translate into pipeline?

If not, write down one change you’d make next time to improve how signals feed into execution.

Lesson 5: Reporting (Leading indicators over MQLs)

Why this matters

ABM breaks when it’s judged by the wrong metrics.

For years, marketing has been measured on MQLs, form fills, and vanity numbers that don’t reflect real buying behaviour. In an ABM-led demand engine, those measures simply don’t work.

If the goal is to build pipeline and revenue from target accounts, reporting needs to track movement across the whole journey, not just downloads at the top.

The reality is that ABM influence often happens long before an opportunity is logged. If you can’t capture those early indicators, you’ll struggle to prove value, build trust with sales, or secure budget to scale your programs.

The biggest truth to remember is this:

If your target accounts don’t know about you, they’ll never buy from you. Awareness is the first win. That’s why it’s so important to measure ABM at the account level before an MQL even exists.

We look at:

- Are target accounts showing repeat engagement with ads or content?

- Are more contacts from the same account interacting with us over time?

- Are we seeing growth in awareness and buying committee penetration?

The goal is to move accounts into and through the funnel. By tracking engagement and awareness at the account level, we can optimise, pivot, and prove ABM’s impact long before pipeline is booked.

Reporting must capture leading indicators (new contacts, repeat engagement, buying group growth) and lagging outcomes (pipeline and revenue) and tie them together in a single view.

That’s what turns ABM measurement from vanity metrics into a credible growth engine.

How Cognism does it

Reporting on ABM performance starts with a fundamental mindset shift:

Pipeline over leads, and signals over form fills.

We don’t judge success by how many MQLs get passed to sales. Instead, we look at how accounts progress through engagement stages and whether that engagement converts into revenue impact.

This requires a broader lens than traditional reporting. Rather than celebrating vanity metrics, we’ve built a framework that tracks three interconnected layers of performance across every ABM motion.

1. Leading indicators - pre MQL

Account penetration (Marketing vs Sales + unified view)

Marketing view:

From a marketing perspective, we measure account penetration by touchpoints and engagement. We track:

- Ad interactions and engagements (via Dreamdata).

- Overall account engagement scores.

- Journey views that show how an account interacts across campaigns and content.

This helps us see if marketing generates enough awareness and activity to build momentum inside the account.

Sales view:

On the sales side, we assess penetration by activity and contact coverage. We look at:

- The average number of SDR tasks completed per account (and whether this is increasing month over month).

- The average number of engaged contacts per account.

- Whether that number of contacts is above the threshold needed to effectively multi-thread into a buying committee.

This tells us if SDRs are speaking to the right people and achieving sufficient coverage across the account.

Unified view:

The most powerful perspective comes when you combine both.

By layering marketing-driven engagement scores with SDR activity levels, we get a true picture of account penetration:

- If engagement is high but SDR tasks are low → we’re not doing enough from an outbound perspective.

- If both engagement and SDR tasks are high but the account still hasn’t moved into the funnel → it’s likely the account isn’t in-market, so we deprioritise it and replace it with another.

This unified view ensures sales and marketing are aligned on whether we’re doing enough in each account to create pipeline, or whether it’s time to pivot.

Meeting booked conversion rates vs engagement score

In ABM, we take an allbound approach; it doesn’t matter whether an opportunity comes through inbound channels or is booked by an SDR. What matters is that pipeline grows.

One of the most telling data points we track is the link between account engagement scores and SDR conversion rates. The trend is clear:

The more engaged an account is, the easier it is for SDRs to book meetings.

On average, we see meeting-booked conversion rates around 23% when an ABM account has an engagement score above 50%.

The more accounts we can push past that engagement threshold, the more momentum SDRs have when prospecting into them.

And the effect compounds. As the graph below shows, accounts with a 100% engagement score convert at significantly higher rates from outbound outreach, proof that driving engagement before prospecting directly increases SDR effectiveness.

The first sign of success is whether our campaigns resonate with the right accounts.

We track signals of intent and engagement, not just clicks. That means looking at repeat content engagement from ICP accounts, surges in product and pricing page traffic, key stakeholders’ webinar attendance, and new contacts surfacing within target accounts.

These metrics give us an early read on whether the right people are paying attention and leaning in.

2. Pipeline influence

The next layer is where sales and marketing alignment really matters.

Instead of wasting time debating attribution, both teams share the same dashboards showing how many opportunities they’ve created within target accounts, how quickly they’re progressing, and the quality of those opportunities.

Focusing on opportunity creation and velocity at the account level gives us a much clearer picture of ABM’s impact on pipeline health.

3. Revenue impact

Ultimately, the most important validation comes from closed-won revenue.

At Cognism, we connect deals directly to the campaigns, signals, and assets that helped move them forward.

This closes the loop on ROI, ensuring we can prove not just activity, but actual revenue outcomes from ABM investments.

All of this data lives inside integrated dashboards that both marketing and sales teams use every day. Because we all work from the same definitions and look at the same numbers, disputes over “what counts” disappear.

ABM performance becomes a shared story rather than a point of contention.

But the numbers aren’t the whole story. Weekly feedback loops mean we go beyond dashboards.

Sales reps feed back live intelligence on what they hear in conversations, and marketing adapts messaging, targeting, and campaign tactics in response.

It’s a living, breathing system: signals, pipeline, revenue, and real-world feedback all feeding into one continuous cycle of improvement.

Course homework

Choose at least one exercise to apply what you’ve learned:

1. Bucket accounts by engagement score or stage

- Take your current target account list and sort by engagement score or account stage (e.g. nurture, working, meeting booked).

- Identify which are your lowest- and highest-engaged accounts.

- Map each account stage to the relevant ABM deployment model (1:Many, 1:Few, 1:One) with a clear rationale.

- Outline one action you’d take to move accounts from their current stage to the next.

2. Build a unified account view with Sales

- Work with RevOps/Marketing Ops to create a single account dashboard that combines:

- SDR tasks completed per account (sales effort)

- Engagement score (marketing impact)

- Analyse the data to find gaps, e.g. accounts with both low engagement and low tasks completed that risk stalling.

- Share your findings with Sales and agree on a joint prioritisation plan.

3. Reporting for signal-led ABM

- Define which signals and metrics matter most for each stage of the ABM funnel. For example:

- 1:Many → account reach and ad engagement

- 1:Few → signal stacking (intent, job join growth, competitor renewals)

- 1:One → buying committee penetration and SDR task coverage

- Build a simple reporting framework that ties leading indicators (engagement, new contacts, buying group growth) to lagging outcomes (pipeline, revenue).

- Write a short reflection on how this framework would help you prove ABM’s impact internally.

Wrapping up module 4: Turning ABM into a pipeline engine

If Module 3 showed us how to scale attention with a content engine, Module 4 proves how to focus that attention where it matters most: the accounts most likely to generate enterprise revenue.

ABM is not a siloed tactic - it’s the discipline that turns your demand engine into targeted pipeline.

Your ABM engine checklist

If I were rebuilding an ABM program from scratch today, here’s the order I’d follow:

- Get the foundations right

ABM starts with ICP clarity. Without it, no amount of intent data, content, or orchestration will save you. Define who your best-fit accounts are and commit to precision over volume. - Build with tiers, not wishlists

Don’t flood sales with thousands of “priority” accounts or limit focus to a handful of logos. Structure into 1:many (broad awareness), 1:few (in-market cohorts), and 1:one (live opportunities) so resources match revenue potential. - Make sales + marketing one team

ABM collapses without alignment. From account selection to reporting, build shared dashboards, feedback loops, and co-owned targets. Sales provides ground intelligence, marketing fuels scalable plays - together they move accounts forward. - Orchestrate multi-channel engagement

Enterprise deals are committee-driven. Map champions, influencers, and blockers, then surround them with personalised touchpoints: microsites, tailored ads, curated dinners, and outbound air cover. Relevance across roles builds momentum. - Measure signals, not just outcomes

Pipeline and revenue are the lagging indicators. But leading signals - repeat engagement, buying group growth, and account penetration - tell you early if ABM is working. Align reporting to account movement, not MQLs. - Treat ABM as demand gen with focus

The tactics don’t change: content, events, ads, outreach. The difference is precision - aiming them at the exact accounts and committees that matter most, and layering personalisation to accelerate velocity.

Done well, ABM doesn’t just win bigger deals—it creates a scalable engine where every marketing play and every sales touch compounds into revenue impact.

About Tim Hughes

Tim built and runs Cognism’s ABM engine, turning strategy into pipeline with personalised content and signal-led outreach. His work bridges the gap between brand and revenue, showing how tailored campaigns aimed at the right accounts can create demand where it matters most.

In this module, Tim shares how he’s applied ABM principles in practice: combining data signals, creative storytelling, and multi-channel distribution to engage senior decision-makers and influence enterprise deals.

Ready to put it into practice?

Put your ABM know-how to the test. This quick quiz will check your grasp of the core pillars and show you how to sharpen your strategy for bigger wins.