PILLAR REPORT

Inside Inbound 2026

It’s safe to say that 2025 has been a whirlwind for inbound. In fact, maybe that’s even putting it lightly.

Attribution is (even more) hard. LLMs and Google’s launch of AI Mode have been eating into your organic traffic. And on top of that, most budgets got tighter.

But what do all the datapoints we have tell us about what’s in store for next year?

Well, as marketers, we wanted to know too, which is why we’ve run a report on the state of inbound and the plays you need to thrive in 2026.

Here’s our POV. 👇

TL;DR: what the data is telling us

Inbound is evolving faster than ever. The old playbook of “drive traffic, and get form fills” is breaking down under the weight of AI search, community-led buying, and new intent patterns.

Here’s the short version:

- Organic search is still powerful but changing form. Our organic traffic is down 33.6% year over year (YoY), but direct MQLs are up +6%, showing buyers now revisit brands directly after off-site research.

- LLMs are officially a new inbound channel. Self-reported attribution for AI and LLM sources grew +9.25% YoY, supported by the fact that other sources cite ChatGPT as driving nearly 80% of chatbot referrals.

- Paid search remains the inbound efficiency engine. Google still leads with 6% MQL to closed-won, while Bing delivers a leaner 8.9% close rate on smaller volume.

- Social assists, search converts. LinkedIn and Meta create demand; search and direct capture it. Teams that align these roles are already winning on return on ad spend (ROAS) and conversion.

- Content’s influence is shifting off-site. AI summaries, LLM citations, and community threads are now major decision touchpoints. Buyers shortlist before they ever hit your homepage.

- Inbound sales cadences win on precision, not persistence. Cognism’s best-performing sequences book meetings at 50-90% when calls happen within minutes and outreach stays lean (7-9 touches in 10 days).

The signals are clear:

Inbound’s future is zero-click, AI-assisted, and (even more) buyer-led. The brands that thrive are the ones that adapt early. Those CMOs still operating a lead generation motion should rethink, as it’s about to get even harder to make it a success.

Data methodology

Our research began with diving into our own data. Leveraging multiple platforms, including our CRM, Dreamdata, Outreach, and ad platforms, we extracted the data points for inbound leads year to date and, where possible, compared the dataset to 2024 for the same period.

We target the lower, middle, and top end of the market with different data offerings and span several industries, so this report offers a wide perspective. To give an even wider view and to help support our claims, we also carried out deep research leveraging other available research that’s no older than two years.

Proprietary data sources

- Dreamdata: Data-driven attribution model to review channel, platform and campaign performance.

- CRM: Last touch channel and self-reported attribution.

- GA4 and Google Search Console: Organic search and traffic data.

- Outreach: Inbound campaign performance.

- Ad platforms: Paid search and LinkedIn channel campaign performance.

Attribution integrity

We never blend Dreamdata (data-driven) and CRM (last-touch). Each data point and conclusion is explicitly level with its model and time window. Any cross-model comment is descriptive, never arithmetic

Definitions

- How we define Marketing Qualified Leads (MQLs): For the purpose of this report, MQLs are high-intent leads who have come in through actions such as demo requests and the pricing page. We operate using a demand generation motion, so this is our internal definition for them.

- How we define Sales Qualified Opportunities (SQOs): A Sales Qualified Opportunity (SQO) is where an opportunity has been created. This means there’s sales pipeline and an estimated attributed value if the deal closes.

- How we define influenced leads: An influenced lead is where an MQL has had a touchpoint before converting to an MQL with a particular piece of content, campaign, landing page, and so on.

- How we define influenced value: Influenced value is where pipeline or revenue can be attributed to that specific touchpoint, regardless of which channels contributed. For example, if a prospect viewed a specific blog page on their journey to become a SQO, it would contribute towards a touchpoint that influenced that value.

The channel mix performance leaderboard

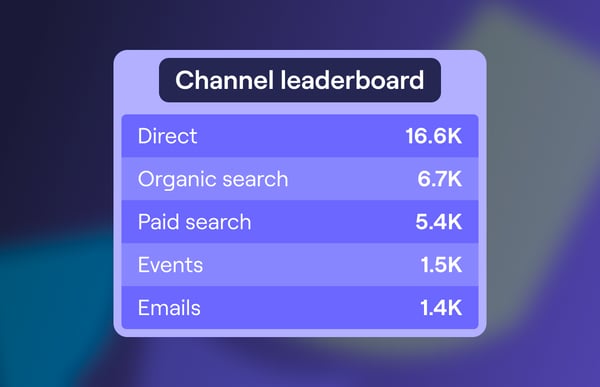

In 2025, organic search, paid search, and direct dominated our channel mix in terms of influenced leads.

When we look into the data for influenced leads, the share of each channel is similar, with those top channels still making the top three.

Share of total leads by channel:

- Organic search: 24%

- Paid search: 19%

- Direct: 11%

- Events: 4%

- Emails: 3%

So which inbound channels are pulling the most weight?

Purely from a conversion perspective, organic and paid search command the lion’s share of total leads. Their momentum has started to cool since summer, likely due to seasonal impacts and the shifts in search (which we’ll come on to later).

What’s changed most vs last year for inbound?

Direct has shown the clearest year-on-year gains (+6%). This shift is due to several factors, including an increase in unassigned traffic, the move to zero-click search, and users’ preference for coming back through brand when they’re ready to convert.

Which inbound channels converted down the funnel the best?

Paid search and direct carry both scale and close; organic search has the biggest volume with meaningful headroom on SQOs and closed-won.

What the funnel says by channel at last touch:

|

Channel |

MQL to meeting booked |

MQL to SQO |

MQL to closed-won |

|

Google paid |

35.7% |

29.5% |

6% |

|

Direct |

34.2% |

27.9% |

5.6% |

|

Google organic |

25.2% |

19.5% |

3.2% |

|

Bing paid |

35.6% |

27.7% |

8.9% |

|

Bing organic |

30.3% |

24.2% |

6.7% |

|

LinkedIn paid |

33.4% |

26% |

2.7% |

What to consider in your channel mix for 2026

When considering your channel mix for 2026, it’s wise to continue to double-down on what’s already working.

Based on our data, here are some surefire routes we’ll be taking (and maybe you should, too).

Defending demand capture, particularly with branded search

Brand campaigns have been the cheapest and cleanest capture of in-market demand, and they outperform generic in lead to value.

Although we’ve experimented with incrementality testing in the past year, reducing coverage on these campaigns has proven not to be an option in the current climate. The competition is just too steep, and we need to secure brand impression share here as much as possible.

Keep paid search vs paid social efficiency and roles

As we follow a demand generation motion at Cognism, we see paid social as a create demand channel.

On the other hand, we use paid search for demand capture, and this is reflected in our return on ad spend (ROAS) data.

Invest in content assets that resonate the most

We re-launched several of our big rock assets in 2025. Some of these, like our SDR Zone, make up our heavy hitters from a content perspective.

We’ll continue to invest in and refresh assets like this in 2026.

LLM-optimisation belongs in your inbound mix

Generative AI and LLM channels serve as fuel for inbound. From our data, we know that this channel has grown massively compared to last year, growing +345% as a last-touch source for MQLs.

From our traffic, we know that ChatGPT is the largest source (it makes sense with their market share). Separate studies support this, saying ChatGPT sends 79.8% of all chatbot referrals to websites (Starcounter).

The death of traffic and rise of a zero-click era

There’s probably been no bigger inbound channel disrupted in 2025 than organic search. It all began in January, when it was reported that Google’s market share had dropped below 90% (Search Engine Land) for the first time in 10 years.

The far-reaching implications of this go way beyond the narrative that “SEO is dead” (which it’s not btw). It impacts the way we’ll attribute in the future and how buyers use traditional search in the buying journey.

The reason why Google’s share is falling is simple: new market entrants causing a shift in search behaviour. When ChatGPT and co. came along, search was disrupted. Now buyers can get direct answers to their questions, based on much more complex queries than ever before. All without even visiting a website.

The result for inbound marketers is, in short, less traffic. Something that, up until this point, had often been accepted as a KPI in boardrooms around the world.

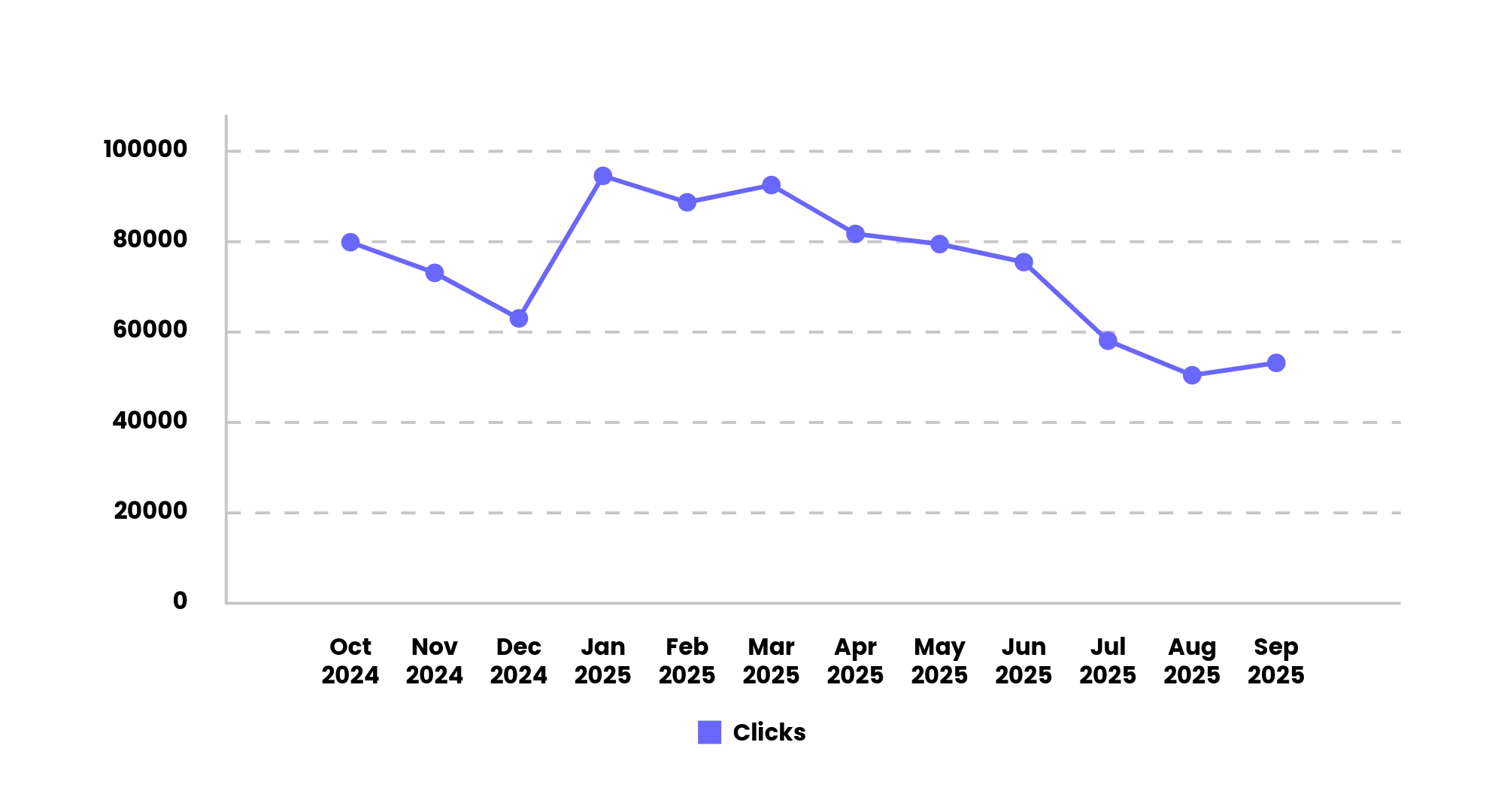

Cognism has not been immune to this shift, with organic traffic declining -33.6% year over year (GA4), also not helped by Google’s silent cookie update (LinkedIn). We see it in the number of clicks reducing, too: -23% over the last 6 months vs the previous, according to our Google Search Console data.

What zero-click search means for inbound in 2026

Going into 2026, zero-click isn’t an edge-case; it’s going to become the default outcome for a majority of searches.

You can continue to expect fewer clicks to your website, particularly for informational queries. Inbound SEO, GEO, AEO or whatever you want to call it, has to account for being cited, as well as traditional blue-link rankings.

Your 2026 zero-click mini-playbook

Although your traffic is falling, organic search isn’t a channel to rule out. Change always presents huge opportunities, particularly if you’re already well established in traditional SEO activities or are in the position to be an early adopter.

Optimise for answers, not just clicks

- Spend time building brand mentions, whether that be through list-swaps, PR, or social media channels that LLMs find authoritative, like Reddit.

- Design content for answering with query fan-out in mind. LLMs and Google’s AI Mode run hundreds of queries when prompted so they can form the best answer.

Get more deliberate about your topic selection

- Zero-click searches mean targeting your low-volume/high-intent keywords is more valuable than ever. Appear for the queries your customers use when they are in-market.

- Build out a topic map (Growth Memo) to focus on building content with topical authority for your ideal prospects.

Change the way you report on organic search

- Measure growth in branded searches and traffic coming to your homepage as KPIs.

- Report on Share of Voice (SoV) across the key topics related to your product or service features.

- Measure SoV against your key competitors to understand the benchmark of where your performance is.

Channel growth in self-reported attribution

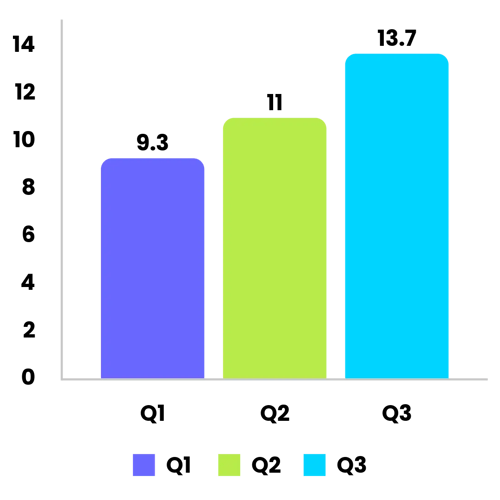

When it came to self-reported attribution, LLMs continued to headline growth (+9.25% YoY), with growth shown during every quarter year to date in 2025.

LLM percentage share in self-reported attribution growth in 2025

Here were the other channels that grew:

- Google/web search +1.6%.

- Word of mouth/referral +1.4%.

- Reddit +0.28%.

- Previous customer +0.23%.

This mirrors what we’re seeing in the wild. As mentioned in the previous section, more answers are delivered off-site, and more decisions are shaped by communities and peers before the last touch.

What else supports these self-attributed findings?

We know that AI has caused the buyer journey to shift even more.

Increasingly, your prospects are using LLMs like ChatGPT or Google’s AI Overviews in their journey to help verify the information they’ve heard from their peer networks or communities.

We already know from research that users are less likely to click on result links when visiting search engine results pages (SERPs) with AI-generated summaries. 26% of pages with an AI summary ended the browsing session completely, vs 16% when only traditional results were available (Pew Research). If you’re not listed, there aren’t many trust signals you can send to help prospects verify what they’ve already heard.

Although word-of-mouth, Reddit, and previous customers showed much smaller increases, we know they’re an unlikely last-touch channel. 72% of people start their buying journey by asking people or communities they trust before moving to public sources (Wynter).

Your next steps for self-reported attribution in 2026

You don’t want to sleep on self-reported data. It’s a goldmine for filling in the gaps your UTMs miss. Here’s how you can get ahead:

- Put spend where self-reported attribution is growing: Report on it monthly and quarterly to track influence and share for each channel.

- Earn AI citations: Our data shows that AI/LL is growing in SRA, and we’re not the only ones.

- Find a way to systemise your referrals: Do you have a champion/referral programme? We know that prospects are increasingly starting their research within their own networks, so these will help you have someone on the inside to advocate for you.

Paid spend looks the best on paper

Paid search looks like the best channel in terms of ROAS efficiency, but it’s only on paper.

For us, paid media isn’t just a tap for quick form fills. In our data, it’s the system that creates mental availability across the 95% not in-market and captures intent the moment it spikes.

But LinkedIn is vital for those 95% not in-market right now to take up mindshare and educate new buyers about what we do.

The difference between a costly click and efficient closed-won revenue comes down to how tightly we run paid search for capture and how deliberately we use paid social media to create demand.

At a glance, here’s what the numbers say:

- Google paid search remains the most dependable scale and efficiency engine, evidenced through the highest MQL to closed-won percentage (6%), which year-on-year is up 0.3% despite slight dips elsewhere in the funnel.

- Bing paid search is a high-efficiency pocket on a smaller scale, with the MQL to closed-won rate sitting at 8.9%.

- LinkedIn paid primes our buyers and (rightly so) is weaker at the close (2.7%).

Paid channel read-outs (what we saw, why it matters, what we’re doing)

Now let’s get a bit deeper into a paid channel-by-channel breakdown. Here’s what we saw this year, and what we’ll be doing about it next year.

Google paid is for dependable capture

Google paid search converts best at capture, shown by its closed-won rate.

We’re keeping match types disciplined, negatives aggressive, and landing pages aligned to direct (objections, proof, pricing clarity) with quarterly landing page refreshes to defend performance.

Bing paid is efficient, but fragile up-funnel

Bing remains a high-efficiency pocket at a smaller scale, but early stages regressed.

It closes when the fit is right, so we’re cloning only top Google cohorts, running monthly search-term QA, and enforcing CAC/payback guardrails to scale it surgically rather than broadly.

LinkedIn paid is our primer, not pusher

LinkedIn warms the right buyers but isn’t our closer. We use it to assist our capture channels, as our always-on problem, proof, and offer sequence.

Meta/Facebook is to retarget-first

Meta works best as surround sound and warm remarketing rather than a last-touch closer.

We’re keeping short, offer-led creative, warm-only lookbacks, and pushing content closely related to our product like prospecting tips until percentage points recover.

What to take into your paid strategy for 2026

Here’s what to take from our data into your paid plan for 2026.

Treat paid search like a product

If you want reliable, repeatable capture, run search like you’d run your product roadmap. In our data from this year, Google delivered the highest MQL to closed-won (6.0%), +0.3% YoY, even with conversion to meeting-booked (−1.9%) and SQO (−1.6%).

We keep match types disciplined, negatives aggressive, and landing pages written to the objections that actually close (the same ones converting through direct).

For Bing, we scale surgically behind proven Google cohorts and keep the conversion at around 8% with CAC/payback guardrails.

Re-role social as the assist engine

If you’re scoring LinkedIn on last-touch alone, you’re underfunding a key lever. Our 2025 read:

LinkedIn closed-won at 2.7%, yet those same warmed cohorts later closed via Google (6.0%) and direct (5.6%).

We run LinkedIn always-on to build familiarity, then remarket to money-page engagers. We judge success on assisted SQO/won and account-level engagement, not just CPL.

Meta under-indexed at close (−7.1% YoY), so we keep it warm remarketing first, with short lookbacks and speed-to-touch tests (tap-to-chat, instant connect).

Segment-first scale

Don’t scale where you wish it works; scale where it already does.

For example, mid-market is our near-term growth lane (+0.38% YoY, with rising volume), so search expansion starts there. In 2025, we began launching ABM programs alongside our traditional paid strategy, and so next year we’ll likely continue scaling that.

Make creative your growth lever

Your copy won’t save weak creatives. We run a 4-6 week refresh cycle and stick to single images and short videos as workhorses on LinkedIn. Every asset ladders into a clear objection or proof point that already converts on landing pages or organic product pages.

Big content pieces become many small, testable units: hooks, carousels, 30-45s clips. It keeps social effective as an assist and protects Google’s 6.0% close-rate by aligning the message buyers actually act on.

Measure what drains your budget

Stack your reporting with monthly MQL, to meeting-booked, to SQO, and closed-won ladders, plus an assist board that shows LinkedIn and Meta exposure.

For spend, anything that misses both efficiency and conversion thresholds two months in a row gets paused. Budget should follow where you add percentage points at business stages, not where you buy the cheapest clicks.

The goals for content in inbound are changing

The goalposts are shifting for top-of-funnel content. Your buyers are finding answers off your website (AI summaries, LLMs, communities, and more.).

In our data, this is partly evidenced by the decrease in organic traffic this year, and growing self-reported attribution for AI/LLMs (+9.25%).

Content marketing has to earn the citation where clicks don’t happen, bring unique perspectives to the party, and remove friction where clicks do happen.

What’s changed or stayed the same for content?

- Buyers learn, shortlist, and form opinions before they ever reach your site.

- SERPs/LLMs now provide answers to complex queries in-platform.

- Capture-focused content strategies still win despite the shifts we’re seeing at the top of the funnel.

What all this means for your content (and budget)

This year, we’ve seen the increasing trend of B2B buyers finding answers off-site (AI summaries, snippets, communities) and converting back through direct, with MQLs from direct +6% year over year.

In our dataset, organic traffic has been falling by around -30% over the last 12 months vs the previous, whereas referral traffic from ChatGPT, Perplexity, and Gemini is up between 300%-1,000%. For 2026, brands need to earn citations off-SERP, too.

- Optimise for being cited, not just being clicked. Lead with a 40-60-word, fact-rich summary, explicit entities, and evidence buyers can trust. Use schema where it helps. The goal is to be the source that AI answer engines lift, even when the session never logs.

- Design post-click for speed and certainty. “Money pages” (pricing, comparisons, product) should read like a great first sales call: outcomes, quantified proof, objection handling, and fast paths to talk.

- Invest where peers persuade. Our SRA lift in word-of-mouth/referral says social proof travels. Package proof that’s easy to share, like logo walls, 30-second clips, and stat cards, and seed it in communities that surface in search (e.g., Reddit threads).

- Thread content into capture. Reuse winning content claims verbatim in search ads and landing pages. The message that made them curious should be the message that makes them convert.

Which content brings in conversions and pushes prospects down the funnel

Good marketers understand that each piece of content has a different purpose. Traditionally, this is aligned with a funnel stage.

We spoke earlier about the changing role of top-of-funnel content, and we’ll get further into that here, but first, let’s look at what actually converts.

What actually converts: top transactional URLs

Your transactional pages (pricing, demo, vs pages, etc) are where intent peaks and any leakage hurts the most.

If you’ve got a softer call-to-action (CTA) you can use to get your foot in the door, then use it. It will help prospects who are still making their minds up about whether you should be on their shortlist. The conversion rate of our data sample page, a way for potential prospects to trial our dataset against the competition, shows the effectiveness of softer CTAS.

Here’s a snippet of our top five converting pages for the year:

|

Page |

Views (from users in our CRM) |

Conversions |

CVR |

|

/demo |

107,362 |

9,348 |

8.7% |

|

/pricing |

105,710 |

3,671 |

3.5% |

|

/datasample |

8,132 |

1,227 |

15.1% |

|

/contact-us |

7,493 |

1,222 |

16.3% |

|

/product-tour-demo |

831 |

73 |

8.8% |

What content pushes buyers further down the funnel?

All of our top-performing pages for influencing leads are bottom-of-funnel (BOFU) pieces. They’re designed to help in-market buyers make a decision.

Is there still a place for top-of-funnel content on your website?

There’s some debate online as to whether top-of-funnel (TOFU) has any place on your website. We think insightful, unique, or entertaining TOFU absolutely still does.

With LLMs and AI eating up your content and then spitting it back out in a summary, offering something new is the best way to stand out from the rest.

Think unique perspectives from subject matter experts, data (like you see in this report), or unique formats (e.g., our DG playbook course). LLMs/AI will never be able to replicate unique points of view, or entertain through TOFU (at least not yet anyway).

In addition to this, although TOFU isn’t as impactful at influencing leads as our BOFU content, it does hold more impact in influencing MQL-SQO. In the top 10 of our pages influencing opportunities, 40% of their pieces are TOFU, with unique perspectives like how to pivot from lead gen to demand gen.

Your 2026 content actions that drive growth

2026 content strategies must look different to account for the shifts in search, algorithms and user behaviour.

Here’s what you need to focus on. 👇

Consider your ‘money queries’ not just money keywords

Distributing content across searchable channels is no longer just about targeting keywords (and hasn’t been for a long time).

LLMs/AI are more capable of understanding who the user is. They also use query fan-out to generate answers based on prompts that are much longer than traditional search queries.

How to put it into practice:

- List your top 50 buyer questions by intent. Leverage call listening tools like Gong to do this.

- Distribute them across your product page FAQs and BOFU content pages.

- Track their presence in share-of-voice (SoV) tools.

Don’t just create; distribute, and then distribute again

Distributing content across search channels will continue to get harder. Don’t let any of your website content sit and collect dust; remember, creating is only 10% of the process.

How to put it into practice:

- Create distribution plans for each piece of content you create, especially big rock types.

- Track it across all your distribution channels to assess impact and next steps.

Refresh like a media team

Operate on a 4-6 week refresh drumbeat. Repurpose big rocks into short videos, carousels, and stat tiles that map to objections you know close in direct.

Tie every asset to a stage-lift hypothesis (e.g., MQL, meeting booked, SQO, closed-won). This will help you prioritise and focus on what matters the most.

How to put it into practice:

- Organise your content based on where it influences the user in the funnel.

- Operate blog refreshes based on their tiering (e.g., tier 1 = BOFU content), which will help you prioritise the most important updates first.

Instrument influence, not just last touch

It’s important to look at the customer journey across all stages for impact, not just first or last touch.

How to put into practice:

- Create an assist dashboard for content with influenced leads, SQOs, and closed-won revenue. This will help you see which content is the most impactful for each stage (see the note about tiering content above).

- If you can, include AI/LLM visibility as part of this dashboard.

Inbound sales sequences overview

Inbound wins (or loses) on speed, relevance, and persistence. Across 2025, the cadences that performed best share three traits: fast first touch, short time to live conversation, and focused multi-channel follow-through that stops before there are diminishing returns.

Treat cadences like a product: instrument every step, retire steps that don’t move funnel stages, and let buyer signals (page engagement, intent, etc.) set the path.

What our data says about inbound cadences

In 2025, Cognism’s inbound sales cadences converted 5.6% of added prospects into meetings, with top performers exceeding 50-90%.

The numbers show a clear trend: the most effective cadences front-load contact within the first 48 hours and compress outreach into tight, purposeful sequences.

Across thousands of inbound hand-raisers globally, three signals stood out:

- Efficiency, not volume, drives performance: High-performing cadences reached similar outcomes with roughly one call, one email, and one LinkedIn touch per prospect. That leanness created focus and proved that quality of outreach beats sheer activity.

- Fast response creates compounding advantage: The cadences that produced the highest meeting rates were the ones triggered within minutes, not hours, of a form fill. The first human touchpoint remains the biggest differentiator in inbound success, a finding supported by studies showing that leads are 21 times more likely to become qualified with a quick lead response time (Chili Piper).

- Relevance wins across markets: Language and intent-specific cadences consistently outperform generic ones. For example, our France and DACH demo cadences converted between 58% and 91% of inbound prospects; more than double the global average. Each tailored the message and proof points to the buyer’s market, not just their job title.

At the top of the leaderboard:

- German inbound - 90.7% meeting booked rate; the highest globally.

- DACH inbound - 58.3% meeting booked rate.

- Data sample request inbound sequence - 54.1% booked rate, showing the power of value-based offers.

- Inbound Chili Piper cadence - 50.3% meeting booked rate.

- France inbound - 48.4% booked rate.

Despite the variations in language, product, or audience, they all shared a similar pattern: call-first, email-second, short-cycle, message-matched. In other words, successful teams don’t spray activity; they sequence intention.

The takeaway for sales and marketing leaders?

Inbound success isn’t about stacking touches. It’s about shortening time-to-human, aligning messages to buyer context, and keeping cadences compact enough to sustain momentum.

As buying cycles grow more non-linear, every inbound moment must feel immediate, relevant, and worth a conversation.

Inbound sales cadence plays to scale in 2026

The data clearly shows one thing: inbound wins are becoming less about who responds first and more about who responds best.

By 2026, the playbook for inbound sales will reward orchestration, context, and precision over brute-force volume.

Turn inbound into a precision moment, not a process

The best-performing cadences in 2025 converted between 50-90% of inbound prospects.

Why? Because they operated within a tight rhythm: calls within minutes, short message cycles, and context carried through every touchpoint.

For 2026, make every inbound moment feel like a handoff, not a form fill.

- Route high-intent leads to live connect within <5 minutes.

- Trigger call-first cadences that reference your prospect’s intent signals.

- Limit cadences to 7-9 touches within 10 days; short, sharp, and human.

Build regionally local, not globally generic

Our DACH cadences converted up to 91% because they were built for local buyers, using local proof, language, and tone.

Marketers who still run one-size-fits-all inbound flows will lose ground to those who design for how buyers think and speak.

- Localise cadences beyond translation: adapt proof points, metrics, and tone.

- Equip SDRs with micro-case studies and stats relevant to their territory.

- Test regional variants quarterly to uncover new pockets of efficiency.

Collapse silos between marketing and inbound

Inbound should feel seamless from click to call. Yet, in most B2B orgs, there’s still a chasm between marketing-qualified and sales-activated.

In 2026, top-performing teams will run inbound like a shared motion, not a baton pass. Here’s how to do it:

- Sync marketing automation and sales engagement tools to trigger cadences automatically.

- Feed campaign context (ad creative, content offer, UTM tags) directly into SDR workflows.

- Report on MQL-to-meeting and MQL-to-SQO conversion as joint KPIs.

The tighter the loop between campaign and cadence, the higher your meeting rate, and the less you pay for every inbound click.

Invest in call-led cadences

The numbers prove it: calls remain the highest-yield activity in inbound (and outbound too).

This year, Cognism’s top cadences averaged ~1 call per prospect, and nearly every sequence above 50% meeting rate had call-first logic.

By contrast, cadences that leaned on email-first workflows underperformed despite higher reply rates.

You need to:

- Make calls the first touch in every inbound sequence.

- Train reps to use contextual openers.

- Layer calls with follow-up emails to compound familiarity.

Measure momentum, not just metrics

Marketers often over-optimise for email performance: open rate, CTR, reply rate, instead of outcome velocity.

The best-performing cadences of 2025 all shared one thing: momentum. Meetings booked quickly, without drop-offs or drawn-out sequences.

For 2026, measure:

- Speed-to-connect (time from form fill to first human touch).

- Meetings booked per prospect added.

- Drop-off rate between touch 3 and 6. These metrics tell you whether your inbound motion is frictionless or simply busy.

2026 inbound marketing strategies will be about the three Vs

Inbound marketing in 2026 is going to be about the three Vs: visibility, velocity, and veracity.

- Visibility: Be present where decisions form, not just where they convert. Earn citations in AI summaries, own the conversation in communities, and secure share of voice across your product’s key topics.

- Velocity: Inbound wins on speed-to-human.The best cadences trigger a call within five minutes, not five hours. Marketing and sales alignment is the new revenue moat.

- Veracity: Authority now beats awareness. Top-of-funnel content will only work if it’s credible, fact-rich, and expert-led so that it earns trust in a zero-click world. Each data point, stat, and quote must be the proof that an LLM will want to reference.

The Demand Generation Playbook Course

Our demand generation course gives you the strategies, playbooks, and real-world examples to transform how your business drives revenue. Learn directly from the marketers who’ve made the switch - and see how to build a demand engine that creates pipeline, not just leads.