PILLAR REPORT

State of Outbound 2026

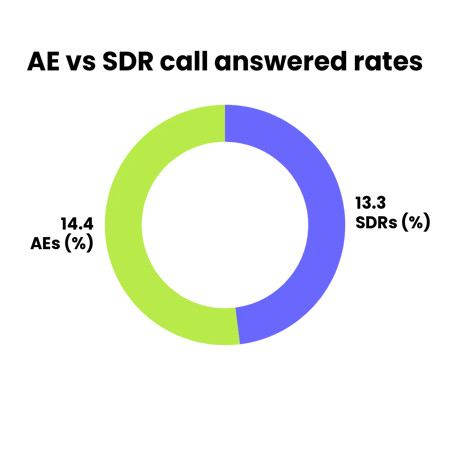

Cognism’s latest data show that SDRs using verified contact data achieved cold call answered rates (13.3%) almost equal to those of AEs calling warm leads (14.4%). In addition, reply rates across both teams outperformed the B2B industry average by up to six times.

This report breaks down the numbers behind that success, revealing how data accuracy, multi-channel cadences, and phone-led workflows are transforming outbound from guesswork into a measurable growth engine.

Start reading

TL;DR: What the data says

- Cold calling is warmer than ever: SDRs achieved a 13.3% answered rate, nearly matching AEs on warm calls (14.4%), proving quality contact data makes cold outreach feel warm.

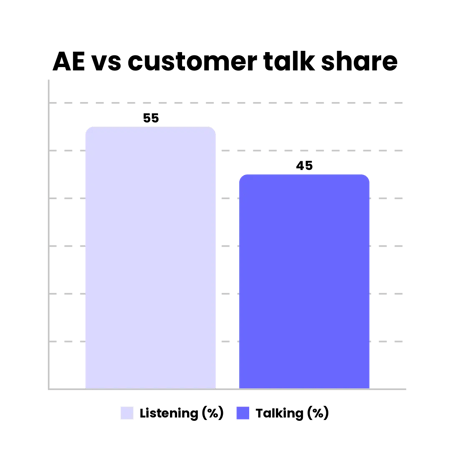

- Conversation quality beats call quantity: AEs with balanced talk ratios (45-55%) and good questioning habits (35-45 questions/hour) delivered more qualified meetings.

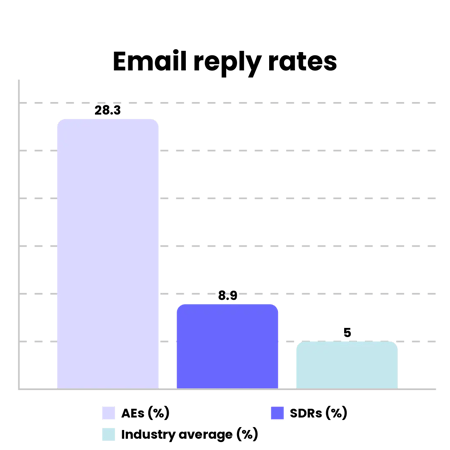

- Quality data drives above-average reply rates: AEs and SDRs achieved email reply rates up to 6x higher than the B2B average, powered by verified contact data and phone-first prospecting.

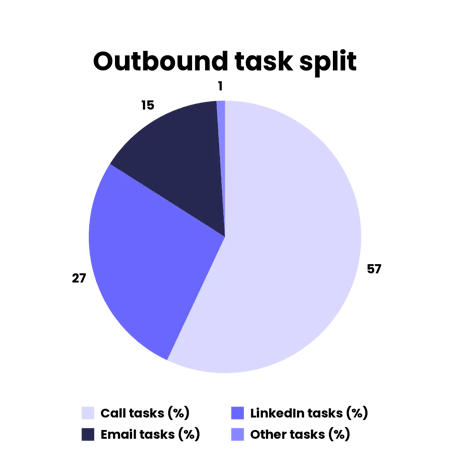

- Phone-first cadences generate results: Calls remain our #1 meeting driver (57% of all tasks), supported by LinkedIn (27%) and email (15%) to create balanced, high-engagement workflows.

Data methodology

The findings in this report are based on a comprehensive analysis of Cognism’s global outbound sales activity throughout 2025.

The dataset covers SDR and AE performance across all active regions, including the UK, US, EMEA, DACH, and France. It combines quantitative metrics from calls, emails, meetings, sequences, and task management systems.

The objective was to identify what behaviours, cadences, and channels most reliably create conversations and meetings in modern outbound teams.

Data sources

All insights were derived from Cognism’s internal sales engagement data, aggregated from:

- Call analytics: Gong call logs (call volumes, durations, and interactivity metrics).

- Email analytics: Outreach email performance (deliverability, opens, clicks, replies, opt-outs).

- Sequence and cadence data: Outreach sequence-level conversion tracking.

- Meeting performance: Salesforce meeting creation and held-rate reports.

- Task tracking: Outreach task completion logs (channel mix and balance variance).

Dataset composition

| Dataset | # of records | Unit of measurement |

| Call activity | 451,895 calls | Calls logged & duration |

| Interactivity metrics | 110 AEs | Talk share, interactivity, question pace |

| Talk track tracking | 110 AEs | Call transcript analysis (talk track frequency) |

| Email sequences | 149,376 emails | Engagement rates |

| Meetings | 39,679 booked meetings | Booked vs held rates |

| Tasks | 573,425 tasks | Channel task mix (calls, emails, LinkedIn) |

Key metrics analysed

For each dataset, a core set of performance metrics was calculated and standardised for comparison:

Call data:

- Call volume: Total and weekly averages.

- Answered rate: % of prospects who responded to outreach attempts.

- Average call duration: Minutes.

- Talk share: AE vs. buyer %.

- Interactivity score: Measures how often a conversation switches between speakers during a call, indicating how well an AE keeps a prospect engaged. Expressed as a score out of 10.

- Questions per hour, and silence tolerance.

Email data:

- Deliverability: % Delivered vs. bounced.

- Open, click, reply, and opt-out rates.

Sequence performance:

- Engagement score: Weighted average of open, click, and reply.

- Conversion rate: Meetings booked ÷ prospects enrolled.

Meetings data:

- Conversion rate: Meetings booked ÷ prospects contacted.

- Meetings-held rate: Meetings held ÷ meetings booked.

- Channel attribution: Calls, emails, LinkedIn, sequences.

Task data:

- Channel share: % of total tasks per channel.

- Overdue rate: % Overdue vs. total tasks.

- Balance score: Variance across channel distribution.

Analytical approach

All numeric values were standardised and outliers removed (for example, 0-minute duration calls and duplicated activities).

Percentage fields were converted from string format to numeric for consistent statistical comparison.

Limitations

- All data reflects Cognism’s internal outbound teams and may not generalise across all industries.

- Data excludes inbound, partner, and marketing-sourced opportunities.

How to interpret this report

This report is directional, not diagnostic.

Each section isolates one stage of the outbound process, from first touch to booked meeting, to identify the habits that consistently generate engagement and conversion.

Cognism’s goal with this analysis is to help sales managers benchmark their outbound motions, optimise rep productivity, and build data-driven go-to-market programs for 2026 and beyond.

Cold calling with accurate data has similar pick-up rates to contacts in sales cycles

In 2025, Cognism’s SDRs proved that “cold” calling isn’t really that cold anymore.

With an answered rate of 13.3% (very close to the 14.4% achieved by AEs calling warm contacts in active sales cycles), our data shows that SDRs are reaching the right people at the right time.

The reason? Accurate, enriched data.

Cognism’s SDRs aren’t dialling more; they’re dialling smarter. They power their calls with verified contact data, intent signals, and prioritised lists. This helps to narrow the gap between totally cold outreach and warm conversations with people already in the sales cycle.

What the data says

Our analysis compared outbound activity from SDR (cold outreach) and AE (warm outreach) teams throughout 2025. Naturally, there were differences related to call volume and average call duration. The average call duration for AEs was four times longer, reflecting a more thorough conversion process to conduct additional discovery and discuss open opportunities.

| Metric | AE teams (warm outreach) | SDR teams (cold outreach) |

| Total calls | 1,962 | 449,933 |

| Calls via sequences | 533 | 320,231 |

| Answered rate | 14.4% | 13.3% |

| Total time spent | 16,392 minutes | 922,770 minutes |

| Average call duration | 8.3 minutes | 2 minutes |

Summary of the key findings

Precision beats volume

Cognism’s SDRs made nearly 60 times more calls than AEs, yet their answer rates were almost identical (13-14%).

It means list quality and timing, not raw volume, determine our reps’ call connection success.

Accurate data makes cold calls feel warm

SDRs achieved an answered rate almost equal to AEs (13.3% vs 14.4%), despite calling completely cold prospects.

This shows how accurate, verified data is closing the gap between cold and warm outreach. With precise targeting and intent-led prospecting, SDRs are connecting with the right people to make every “cold” call a warm opportunity in disguise.

Sequencing matters, but personalisation wins

Around 70% of SDR calls came from sequences (vs 27% for AEs).

Structured cadences drive consistency, but over-reliance on automation risks losing the personal touch that drives meetings.

Your 2026 cold calling action plan

1. Make data accuracy your competitive edge

The SDR team’s near-parity with AE answered rates proves that quality data powers meaningful dials.

Cognism SDRs have better conversations because they:

- Call the right contacts (decision-makers, not gatekeepers), and go in prepped with deeply relevant information.

- Use verified mobile numbers (AKA, Diamond Data® that connects you with more people on your list than standard mobile numbers).

- Focus on the main goal, which is pushing for the meeting to be able to do deeper discovery.

Keep your outbound contact lists fresh, validated, and intent-ranked to ensure every call starts informed.

2. Keep your lists refreshed and use intent

Cold calling all starts from your list of target accounts, and did you know that if you can be in front of your buyers first, you’ll increase your chances of closing that deal by 74%? Keeping your lists refreshed and leaning on intent to prioritise accounts is crucial.

Isa Sher, Senior Sales Manager at Cognism, and the host of our Cold Calling Live webinar says:

“Start with a well-vetted list of accounts. We tier ours based on the availability of decision-maker contact data so we can prioritise accounts with multiple relevant stakeholders. The more stakeholders you have bought in, the higher your chances of breaking in. Having mobile numbers is key — it means less time wasted and more actual conversations, not just dials.”

“Make sure you review any new accounts that move into your high-priority list each week so you don’t miss any warm or ready-to-buy companies.”

3. Personalise within the sequence using company research

Sequences create structure, but personalisation creates connection. Use sequencing as a framework by tailoring messaging to prospect triggers, persona pain points, and buying signals.

At Cognism, we lead with phone-led cadences. Cold calling is still the most effective channel for outbound because reps get feedback in real-time, and can use their personality to stand out more easily than on digital channels.

Isa says:

“Our SDR teams use Cognism to speed up the company research process. The AI research feature gives you an overview of the company’s goals, direction, competitors, and latest news.”

“It helps us save so much time as part of the outbound sequence, with reps spending 15 seconds vs up to 15 minutes finding out info about the company to personalise outreach.”

4. Align SDR and AE feedback loops

With buyers more informed than ever, your SDRs and AEs need to be more aligned than ever. Feed SDR call outcomes and buyer insights directly into AE engagement strategies.

Isa says:

“At Cognism, we have regular feedback loops between SDRs, and AEs. Each SDR has an AE they’re ‘buddied up’ with, which means that there’s a constant two way communication.”

When both teams operate from the same data-driven understanding of the customer, warm follow-ups turn into qualified opportunities faster.

Balanced and question-led discovery calls win

In 2025, the AEs that drove the most revenue didn’t sell harder; they listened better.

Cognism’s data shows that conversation quality is the most significant key performance indicator. The top performers run their discovery calls like collaborative workshops; equal parts curiosity, silence, and structure.

It’s not about having the perfect pitch anymore. You must create a space where the buyer feels heard, informed, and understood.

What the data says

| Metric | Average | Median |

| Talk share (% AE vs customer) | 47.3% | 50.0% |

| Call interactivity score | 8.15 | 8.21 |

| Questions per hour | 40.5 | 36.4 |

| Patience/silence tolerance | 0.58 seconds | 0.55 seconds |

| Longest AE monologue | 86.5 seconds | 82.0 seconds |

| Longest buyer segment | 95.3 seconds | 91.8 seconds |

Summary of the key findings

Balance drives engagement

The most successful AE calls were those that were two-way. Calls with a 45-55% AE to customer talk share achieved the highest interactivity scores.

AEs who balanced talking and listening created the best conditions for collaboration and insight.

Asking questions correlates with success

There is a strong positive correlation (r = +0.53) between the number of questions per hour and interactivity. In practice, AEs asking roughly 35-45 questions per hour consistently ran the most engaging calls.

Silence is underused, but powerful

Patience (the waiting time between responses) had a minimal direct impact on engagement.

But Cognism’s top AEs intentionally used short pauses to elicit deeper responses and surface hidden objections. Staying silent helps to draw out anything else the prospect has to say, rather than filling the space yourself.

Monologues kill momentum

Interactivity dropped sharply when an AE monologue exceeded 90 seconds. High-performing AEs frequently handed back the mic, transforming one-sided conversations into open dialogue.

Your 2026 conversation quality action plan

1. Coach for conversational balance

Coach your AEs to keep the customer talk time within 45-55% of the total call time. This is the range where engagement and qualification depth peak.

Shivan Pillay, Sales Coach at Cognism and the host of the Why Did it Fail? Podcast says:

“Focus on the discovery so that you’re not asking 17 new questions back-to-back. Ask a question, and then probe further for an answer. ”

“So, for example, you could ask, ‘Okay, so with that workflow, what's your part in it?’ The result is, instead of just stacking questions and making the prospect feel overwhelmed, or more likely just to answer the last question you’ve asked, you’re helping to spread things out.”

2. Practice, practice, and practice for discovery calls

We know that interactivity scores and questions correlate with making sure pipeline gets created. Embed practice for discovery calls into your organisation so you can role-play how your AEs create interactivity.

Shivan says:

“Role playing is critical. I do this all the time with the AEs and AMs that I work with. We’ll co-create a discovery question, statement, workaround, or trial success criteria, and then we’ll role-play what that’s going to sound like on a call.”

“It means that the individual can then go off and try it on the call, and then we can replay that call, chop it up, and find out what works and what doesn’t.”

3. Build discovery frameworks, not scripts

Structure your discovery calls by persona, problem, and impact, rather than relying on word-for-word scripts.

Use open-ended questions that reveal insight, not surface-level needs. Shivan says:

“Ditch the script. Use call frameworks instead. Frameworks give you structure, not a script. They outline the key beats of the call: intro, value prop, discovery questions, objection handling, and close.”

4. Train AEs to embrace silence

Coach your salespeople to pause for 1-2 seconds after questions or objections. This small change allows space for buyers to think and add even more information to what the salesperson already knows.

Shivan says:

“Rather than feeling nervous to fill a gap, embrace strategic silences. I coach all my reps, AEs, and AMs to resist the urge to jump back in immediately. Allowing a few seconds of silence can prompt deeper answers and show the prospect that you genuinely want to hear them out.”

5. Track and coach monologue time

Our data shows that any AE regularly exceeding the 90-second speaking mark risks losing engagement. Focus on call training that replaces lengthy explanations with short questions and valuable insights.

Here’s what Shivan says:

“When you’re on discovery calls, it can be easy to turn it into a one-sided sales monologue. But you need to lead with curiosity to make it a conversation. Don’t show up and throw up with a long product spiel; instead, ask thoughtful questions and listen. The more the buyer talks about their genuine needs, the more likely you can help.”

Structured calls with talk tracks turn conversations into pipeline

The most effective AEs don’t rely on luck; they rely on structure.

Cognism’s data shows that when talk tracks are applied consistently and confidently, customer conversations move faster, stay focused, and lead to a closed deal. The message is clear: disciplined talk track execution turns every call into a catalyst for momentum.

What the data says

How we measured it

For every talk track, we compared tracker use against applicable calls to calculate a usage rate (%).

Low-volume tracks (<5 applicable calls) were excluded to keep the insights clean and relevant.

Most-used talk tracks

- Next steps and process: AEs excel at closing calls with clear subsequent actions and aligned expectations.

- Customer pain and goals: Problem-first framing is deeply embedded in how AEs position Cognism’s value.

- Competition and current provider: Used effectively to reframe buyer perception and highlight Cognism’s differentiation.

- Decision process and paper process (MEDDPICC): Applied regularly in complex cycles, ensuring smoother handoffs and shorter deal times.

- ROI and value statements: Increasingly used to validate Cognism’s commercial impact during live calls.

Category consistency (weighted usage rate)

| Talk track category | Weighted usage rate (%) | Key strength |

| Next steps and process | 91% | Outstanding consistency and clarity in deal advancement |

| Pain and value | 82% | Strong discovery and problem-solution framing |

| Product and differentiation | 79% | Compelling storytelling with product proof points |

| MEDDPICC discovery | 77% | Solid execution across champion, decision and metrics |

| Objections and risks | 74% | Confident, structured objection handling across key scenarios |

Summary of the key findings

Cognism AEs lead with discipline

Consistent use of core talk tracks keeps discovery structured and aligned across teams and regions.

Value-based messaging is growing stronger

ROI and value statements are being woven into more conversations, building commercial confidence early in the cycle.

Discovery excellence is embedded

The customer pain and goals tracks remain the cornerstone of how AEs drive insight-led conversations.

Your 2026 talk track action plan

1. Double down on consistency and frameworks

Continue reinforcing talk track discipline and value frameworks; it’s a proven driver of shorter conversation cycles.

Here’s what Shivan says about consistency on discovery calls:

“It’s about tactical consistency, not just reaching out for the sake of it. The best AEs ensure they’ve mapped at least two or three key stakeholders. That’s what turns a conversation into a solid opportunity.”

“After you get off the call, that’s when the real selling starts. The AE’s not in the room anymore. So, have you created a big enough reason for them to want to work with us? Have you shown what life looks like with Cognism?”

2. Amplify ROI storytelling

Equip AEs with more ROI examples and customer outcomes. Encourage them to integrate value and ROI talk tracks naturally into every stage of their calls. Shivan says:

“The best ROI stories come from inside the customer’s world, not ours. If you can find out what a day in their life actually looks like, then you can tell the story of how Cognism fits into that. Otherwise, you’re just talking about data points and contact rates.”

“Customers don’t care how shiny your product is; they care how many people have successfully used it. Once you can show that, it lands.”

3. Keep discovery at the heart

Maintain the emphasis on open-ended questioning and goal alignment; the combination of “pain” and “goals” talk tracks continues to be Cognism’s competitive edge.

Shivan said this:

“Good discovery is about being curious enough to ask what the impact is to them personally. Not just ‘what’s the business impact’, but ‘[Name], if you don’t sort this out, what does that mean for you?’ That’s where the real motivation comes out.”

“The aim is to find who’s actually affected, the person who’s on the sword if it doesn’t get fixed. That’s where deals move faster.”

4. Turn pain points into compelling business cases

One mid-market AE at Cognism recently used the MEDDPICC framework to tighten their discovery and shorten the deal cycle by building a business case around real cost impact.

Instead of simply positioning Cognism as a better data provider, they calculated the time and monetary cost of poor contact rates for the prospect’s SDR team. By calculating the SDRs’ hourly rate and the amount of time lost to inaccurate or incomplete data, they were able to translate “bad data” into a clear productivity cost, revealing how many paid hours were effectively wasted each week.

They then built a simple slide visualising these pain points:

- Time spent prospecting vs. actual call time.

- Hourly cost of non-productive activity.

- Potential efficiency gains with Cognism’s verified contact data.

From there, they created a compelling event around the need to fix that lost time. They presented it to both the internal champion and the manager’s manager, bringing senior leadership into the conversation earlier.

That early stakeholder engagement, combined with the demonstration of Cognism’s browser extension (showing instant access to verified contact numbers), significantly shortened the deal cycle. The manager could immediately see how the tool cut the “contact-to-conversation” time and directly impacted revenue productivity.

Finally, by mapping procurement and integration needs upfront and storing all materials transparently in Cognism’s digital sales room, typical blockers that delay onboarding were removed.

As Shivan explained:

“The AE created a big enough reason for them to actually want to work with us, not just because of data, but because they quantified what the wasted time really cost.”

5. Maintain precision as you scale

As volume grows, maintaining high talk track usage ensures consistency at scale, turning best practice into brand practice.

Shivan says:

“When you’re scaling, the risk is drifting into broad, one-size conversations. The best AEs keep their use case laser-focused and tactical; clear need, clear impact, clear path to solving it.”

Quality data produces above-average email reply rates

In an industry where most B2B sales emails struggle to get noticed, Cognism’s sales teams are breaking the mould.

While the industry average reply rate hovers around 5% (according to some studies), Cognism’s AEs achieve a 28.38% response rate, and SDRs achieve an 8.98% response rate.

This proves that when emails are powered by verified data, personalised messaging, and phone-led cadences, they stop being noise and start driving conversations.

What the data says

| Metric | AE teams (warm outreach) | SDR teams (cold outreach) |

| Emails delivered | 2,544 | 146,832 |

| Open rate | 67.03% | 54.04% |

| Reply rate | 28.38% | 8.98% |

| Opt-out rate | 1.40% | 1.12% |

Summary of the key findings

Above-average reply rates prove data quality wins

Cognism’s email reply rates outperform typical B2B benchmarks by a wide margin. The difference?

Every email is backed by accurate, verified contact data, which ensures that sales messages reach the right people at the right companies.

Email supports the dialler, not the other way around

Cognism’s cadences are built around phone-first outreach, with email acting as the bridge between touchpoints.

Cognism reps don’t just send emails; they follow up, call back, and connect across channels. The result is higher engagement and reply intent.

Multi-channel sequencing drives consistency

With SDRs sending 60x the email volume of AEs, balance and structure matter.

Consistent cadences across phone, email, and LinkedIn keep Cognism’s teams front of mind—and keep prospects responding.

Precision reduces opt-outs

With precision outreach, the opt-out rate remained below 1.5%. The takeaway: when targeting is accurate and tone is relevant, prospects stay engaged, not frustrated.

Will sales be replaced by artificial intelligence? We answer this big question here. 👈

Your cold email 2026 action plan

1. Use email to reinforce the call

In Shivan’s view, the real value of email in an outbound motion is to document and reinforce what was said on the call, not to start a new conversation.

“If it isn’t documented, it didn’t happen,” he says. “Your follow-up email should capture the key points discussed: the problem, the potential impact, and the next step agreed.”

That discipline depends on having clean, accurate contact data in the first place. High-quality data ensures you’re reaching the right decision-makers, so those concise follow-ups land with the people who were actually in the conversation.

Shivan also cautions against long, generic messages:

“No one reads long emails. Even internally, the only long things people read have ‘holiday’ or ‘pay rise’ in the title.”

“Email should back up what you spoke about on the call, not repeat a pitch. If you mentioned an uplift in contact rates or time saved, that’s what the follow-up should say. Keep it relevant, short, and link to one proof point or case study.”

3. Personalise with purpose

Move beyond name tags and titles.

Reference intent signals, trigger events, and buyer pain points to make every message feel relevant and time-sensitive. Shivan says:

“Lock in on the one or two things that caught the customer’s attention. If they talked about contact rates, stick with that, don’t add five other features they didn’t mention.”

“Be aware of who you’re emailing. If it’s IT, talk about integrations and data security. If it’s a team manager, talk about KPIs. The right content for the right person is what lands. On mobile, if your message says ‘read more’, you’ve already lost them. It needs to be sharp and snappy, like a text that gets the point across in one screen.”

4. Align SDR scale with AE precision

Pair SDR outreach volume with AE relationship-building. When cold emails introduce value and warm emails close it, prospects move through the funnel faster.

Shivan says:

“The best AE-SDR pairs have a culture of openness. The AE shares what works with those personas and gives the SDR space to try, fail, and learn. It’s not about dictating; it’s about joint ownership; my success depends on your success.”

“They sync weekly, sometimes it’s over coffee, sometimes at the laptop, but the point is to have that space where the SDR can say, ‘This isn’t working,’ and the AE can help them see around the corner for what the next objection might be.”

Booking meetings in outbound starts with the phone

In 2025, Cognism’s SDR teams demonstrated that outbound meetings aren’t the result of chance, but rather phone-first, targeted outreach.

The data shows that the most successful reps don’t just send more emails or make more calls; they execute coordinated, phone-led cadences across multiple channels, maintaining consistency and speed from first touch to booked meeting.

Behind every meeting sat a repeatable pattern: calls that opened doors, and LinkedIn or email follow-ups that built trust.

What the data says

| Metric | Total/Average |

| Total cumulative booked meetings | 39,679 |

| Total prospects contacted | 196,470 |

| Total outbound calls | 443,209 |

| Total emails delivered | 146,832 |

| Total LinkedIn tasks | 142,800 |

| Average touches per prospect | 3.36 |

| Total meetings held | 34,336 |

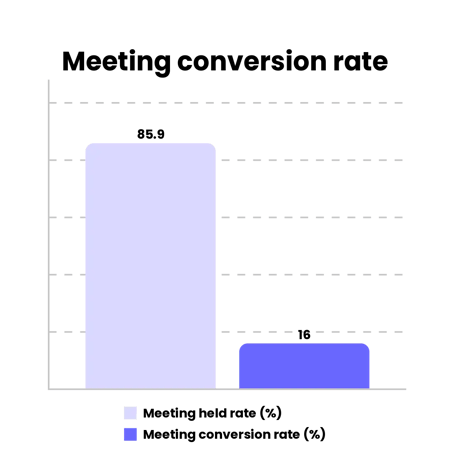

| Average meeting held rate | 85.94% |

| Average meeting conversion rate | 16.06% |

Key findings

Phone-led prospecting powers outbound

Cognism’s SDRs used the phone more than any other channel, providing clear proof that cold calling remains the most effective channel for reaching prospects.

Coverage drives conversion

With almost 200K prospects contacted and an average of 3.36 touches per prospect, Cognism’s SDRs struck the right balance between persistence and relevance.

The best-performing teams hit that 3-5 touch range, enough to stay visible, but not pushy.

Efficiency matched effort

A 16.06% meeting conversion rate across such a large volume signals exceptional data quality and prioritisation.

Cognism’s teams reached the right people at the right time.

Held rates show meeting quality, not just quantity

An 85.94% meeting held rate means that nearly nine out of ten booked meetings actually took place—a clear sign that Cognism’s qualification, intent, and pre-meeting confirmation flows are effective.

Your 2026 phone-first action plan

1. Lead with phone-first outbound

Coach your SDRs to use the phone as their primary method of contacting prospects. Believe us, it works.

We spoke with Hayden Berry, SDR Manager, to gain some more insight. He said:

“Phone-first still outperforms other channels because people want to talk to humans. If you’re buying a piece of software with a $5,000 plus annual contract value, you want to work with a person, not just read an email.”

“The phone is the path of least resistance to say, ‘Hey, I’m a human being.’ It’s also the quickest route to a meeting and the only channel where you control the conversation. With email, the ball is in the prospect’s court; they have to decide to engage.”

2. Standardise three-channel cadences

Calls, emails, and LinkedIn aren’t separate workflows. From our data, the optimal sequence was revealed to be: call, email, and LinkedIn touch within the first 5 days of outreach.

Hayden says:

“A phone-first cadence brings the channels together. Your call and voicemail give you a voice, LinkedIn gives you a face, and your email gives you words. When a prospect has heard your voice, seen your face, and read your name, they’re far more likely to respond. It’s just about catching them at the right time.”

“If I call and you’ve already seen my LinkedIn request or my email, I’ve already won the first 15 seconds of that conversation.”

3. Focus on the right outputs

We maintain our rep cadences at a tight 3-5 touches per prospect. Beyond that, the marginal return drops, while the unsubscribe risk rises, and there’s no point just doing tasks for the sake of it.

Hayden added to our data with this insight:

“We’re big on time blocking. SDRs need to focus on the right inputs, not just tasks for the sake of it. The goal isn’t 75 ‘why you, why now’ emails a day. It’s making the right calls and touches that actually create meetings and pipeline.”

“Hearing one ‘no’ doesn’t mean the whole account’s a no. The best reps know how to multi-thread and find the RevOps leader, the sales manager, and the marketer. You just need your foot in the door to start the conversation.”

4. Track quality metrics vs quantity metrics

Go beyond raw activity. Hayden uses a tracking method centralised around positive dispositions, also known as quality conversation metrics. He says:

“The KPI I care about most is positive dispositions; referrals, callbacks, and meetings booked. The US average is around 30%. It’s how we measure quality versus activity.”

“If you give reps a call number, they’ll just make calls. What I want is 50 of the right calls that deliver a 20% connect rate. The job isn’t to make dials, it’s to create conversations.”

5. Protect the meeting once it’s booked

With show rates already high, even a 2-3% improvement in held rate converts directly to pipeline growth.

Hayden explained that Cognism’s SDR teams follow a structured nurture and confirmation process for booked meetings, based on analysis of the show-rate data.

The process:

- Avoid long gaps: Meetings are never booked more than five days out. Hayden noted that anything scheduled beyond four days had an average show rate of 60%.

- Nurture before the meeting: SDRs share a relevant case study two days before the scheduled call. This reinforces the value of the discussion and keeps the topic fresh.

- Confirm the day before: A brief confirmation email is sent the day before the meeting, reminding the prospect and providing context.

“After implementing this simple sequence, we saw show rates rise from around 60% to 72%, and today their average sits between 80–82%.”“We’re strict about not booking meetings more than five days out. If you book two weeks ahead, you’re probably going to have to reschedule.”

Focus discipline is an outbound task management advantage

In 2025, Cognism’s SDRs turned outbound into an operational science. But across the most successful rep, one thing remained clear: focus.

The data shows that outbound efficiency isn’t about doing more; it’s about doing the right things, in the right order, at scale.

What the data says

| Task type | Global total | Share of total (%) |

| Call tasks | 325,376 | 57% |

| LinkedIn tasks | 151,672 | 27% |

| Email tasks | 87,948 | 15% |

| Other tasks | 8,429 | 1% |

Summary of the key findings

Calling dominates outbound execution

With 57% of all SDR tasks involving phone outreach, Cognism’s SDRs continue to prove that the phone remains the most effective channel for generating live conversations and meetings.

LinkedIn is core to B2B prospecting

Social selling accounted for over a quarter of total activity (27%), indicating that digital touchpoints are fully integrated into SDR workflows.

LinkedIn is no longer a side channel; it’s where credibility and conversations begin.

Email plays a supporting role in engagement

Emails accounted for 15% of SDR tasks, indicating a shift from volume-driven sequences to targeted, intent-based sends that complement calls and social touches, rather than replace them.

Other tasks reflect operational maturity

At just 1.5% of activity, admin and non-revenue tasks remain minimal, proof that Cognism’s SDRs are tightly focused on high-value outbound motions.

Balanced execution = scalable performance

The 57-27-15 channel split represents a healthy distribution between conversation-led, social-led, and automation-led outreach.

This mix is what allows Cognism’s SDRs to scale without sacrificing personalisation or conversion quality.

Your 2026 outbound task management action plan

1. Keep a 55-30-15 balance

Implement at least a 55-30-15 distribution of call, LinkedIn, and email tasks; it’s the operational sweet spot for conversion and efficiency.

Hayden says:

“Email’s the most saturated channel there is. My own inbox is full of unread sales emails that are sitting in my junk folder. But if you cold call me after I’ve seen your LinkedIn DM, I’ll pick up, because there’s familiarity.”

2. Double down on call quality

The number of quality conversations you have is the most critical factor.

Cognism’s approach to developing confident, high-performing SDRs is deliberately structured and hands-on, focusing on early exposure, simple frameworks, and phone-first conversation skills.

Early exposure builds confidence. New hires are on the phones by day four.

“It breaks the fear barrier,” Hayden said. “The fastest way to ramp is live conversation.”

By achieving early wins within the first 30-60 days, SDRs quickly build confidence and learn how to handle real buyer reactions effectively.

Break every call into three parts. Reps analyse their calls this three-stage framework:

- Intro: The permission-based opener - handling the “busy opener” moment (“Hey, is now a bad time?”).

- Body: The relevance zone - capturing attention and tailoring the pitch so it feels specific, not generic.

- Close: The next-step ask - booking the meeting, getting a referral, or actioning the follow-up.

“Breaking calls down this way helps SDRs pinpoint exactly where they’re losing people; opener, relevance, or ask, and fix it fast.”

Focus on human connection in the first 15 seconds. While permission-based openers have worked well, Hayden noted a shift toward authenticity:

“Cold calling is evolving, it’s not just, ‘Do you have 27 seconds?’ It’s about showing you’re human in that first 15 seconds.”

3. Track activity quality and focus

Go beyond raw task counts. Measure tasks-to-meetings and multi-channel conversion rates to identify where the real impact lies.

Hayden says:

“I once ran a training exercise showing how much faster people work when they focus on one thing at a time. It’s the same for SDRs: block time for one task, finish it, then move on. You’ll get twice as much done.”

“That’s why we coach time blocking; one hour for calls, one hour for email, one hour for admin. Focus beats multitasking every time.”

Conclusion

In 2025, Cognism’s outbound data showed that precision, not persistence, drives pipeline growth. Sales teams that use accurate data, multi-channel workflows, and phone-first outreach consistently outperform those chasing volume.

Key takeaways for sales teams:

- Lead with data, not instinct: Verified contact data and intent signals are the foundation of effective outbound. Accuracy beats activity every time.

- Use the phone as your primary channel: Phone-led outreach delivered the most answered calls, booked meetings, and conversions across all metrics.

- Coach for conversation quality, not call volume: Build scorecards around interactivity, talk ratio, and question pacing to coach meaningful dialogue over scripted pitches.

- Operationalise task discipline: Use a consistent 55-30-15 split between calls, LinkedIn, and emails. Discipline creates predictability, and predictability scales.

- Measure the right outcomes: Track answered rate, meeting conversion rate, and meeting held rate, the true indicators of outbound health.

- Align SDRs and AEs: When SDRs pass on insights, AEs enter conversations one step ahead. Create an insight loop between teams.

The cold calling competitiveness gap: Can AI replace your sales team?

Industry benchmarks show cold calling success rates only edging up from 2.3% in 2025 to 2.7% in 2026, while Cognism’s phone-first, data-driven outbound engine is converting at 11.3%, with cold answer rates close to warm outreach and nearly nine in ten outbound meetings going ahead.

This report breaks the gap down for C-suite and Sales VPs, and tackles the real 2026 questions: not just “Can AI replace my sales team?”, but “What model do we need to compete with a 10-11% cold calling success rate?"