Market Insights

Signals behind the scenes: What Cognism’s data reveals about the shifting business economy

Cognism’s data shows that the business economy isn’t slowing down; it’s recalibrating. Companies are building leaner, more integrated, and more data-driven GTM systems, where clean, real-time data becomes the foundation for competitive advantage.

Start reading

Introduction

Every day, our platform captures millions of live signals across companies, leadership teams, tech stacks, and buying behaviours. It’s a dataset few organisations have access to, and even fewer can interpret at this scale. That gives us a proprietary view into how the business economy is shifting beneath the surface, long before those changes appear in traditional market reports.

This data matters because the environment that revenue teams, operations, and go-to-market leaders operate in has fundamentally changed. Buying committees move faster. Tech stacks are shrinking. Leadership churn is accelerating. Intent signals are tightening around fewer, higher-impact themes. Static insights aren’t enough anymore; teams need real-time patterns to make decisions with confidence.

Our aim is simple: to surface the signals within Cognism’s data that help business leaders stay ahead of change, and build more resilient, efficient, and intelligence-driven organisations as a result.

This report covers three critical business trends: leadership, international expansion, and GTM.

Leadership and talent:

- The path to the C-suite.

- Leadership churn.

International expansion:

- Transatlantic expansion persists: UK still the launchpad

Evolving go-to-market insights:

- Buyer intent.

- GTM tech stack.

“Cognism prides itself on ensuring that our mid-market and enterprise customers have the best data available to power and accelerate their go-to-market motions. That puts us in a uniquely privileged position. We’re sitting on a treasure trove of data across the business and economic landscape. This report is designed to extract the key patterns and insights that help you keep your finger on the pulse of the changing trends and dynamics in your world.”

Dominic Allon, CEO at Cognism

Key findings from the report include:

Cognism’s data reveals a business landscape not in retreat, but in a state of retooling. Across millions of companies, contacts, and technographic signals, one theme dominates: efficiency now defines growth.

- Leadership churn is reshaping GTM. Nearly one in ten executives in France and 7.5% in the UK changed employers this year, accelerating buying-committee turnover and new-tool adoption cycles.

- Tech stacks are shrinking, data systems strengthening. HubSpot and Salesforce dominate CRM; Salesloft leads sales engagement. Teams are consolidating tools around integrated ecosystems and cleaner data.

- Governance becomes a growth driver. Privacy and compliance roles now make up ~1 in 5 legal positions, signalling that trust and data integrity are strategic, not operational.

- The UK remains the US gateway to Europe. Over one million S-company employees work in the UK, double France’s total, confirming its role as the transatlantic launchpad.

- Buyer intent follows the same signal. Around 70% of all tracked intent topics relate to AI, automation, or analytics, underscoring a global shift toward productivity-led purchasing.

“Working with thousands of enterprise and mid-market companies gives us a real view of the challenges modern revenue teams face. The trends in this report come directly from those shared patterns, the data challenges, the organisational shifts, and the themes that are shaping how GTM leaders operate.”

Leadership churn is accelerating, and it’s changing GTM dynamics

Cognism’s contact-level data shows that leadership turnover is running hot across Europe’s major markets.

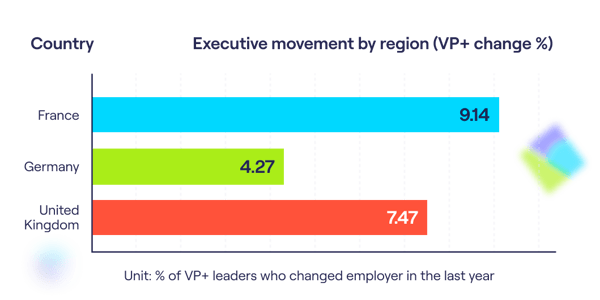

In France, 9.1% of VP-level and above leaders have changed employers in the past year, which was the highest rate among the regions analysed. In the UK, the figure stands at 7.5%, and similar volatility is emerging across the DACH and Benelux regions. This shift marks a steady acceleration in leadership mobility compared with pre-2023 benchmarks, when executive tenure was trending upward post-pandemic.

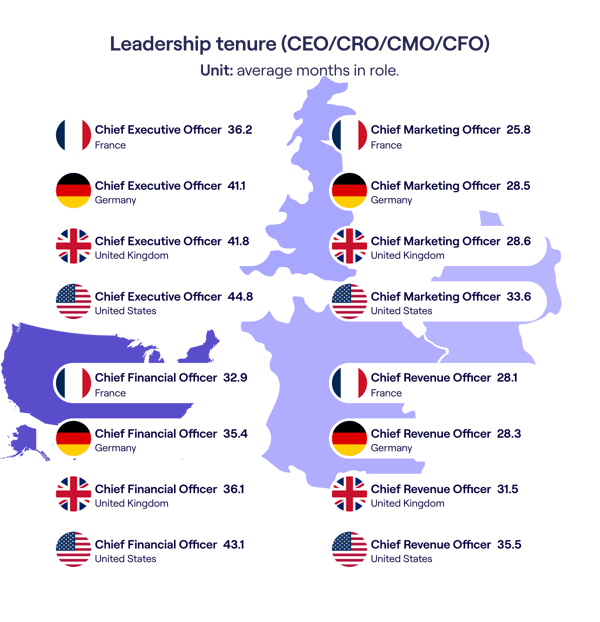

The story becomes even more striking when viewed by function. CMOs now average less than 29 months in role, CROs around 31 months, and CEOs just under 45 months. In other words, the lifespan of a go-to-market strategy often outlasts the leaders who designed it.

Insight spotlight: Leadership churn is hottest in France. 9.1% of French VP+ leaders changed jobs in the past year - the highest turnover rate in Europe.

That volatility has consequences. For go-to-market and revenue leaders, shorter tenures mean faster cycles of relationship-building, more frequent resets of buying committees, and a constantly moving target for account-based engagement. Sales and marketing teams must now navigate buyer groups that are in flux, with decision-makers rotating in and out before long-term deals reach maturity.

The practical impact is clear:

- Account maps age faster. Teams can no longer rely on bi-annual refreshes of CRM data; leadership changes make job movement a critical signal for purchase intent, and businesses need their data partners to proactively deliver fresh records.

- Brand memory becomes more valuable. With executives switching companies more often, reputation and familiarity travel with them, and the brands they trusted previously often get a head start when they move. Not to mention, as LLM-based search becomes a primary discovery channel, well-established brands are more likely to be surfaced, referenced and reinforced during a leader’s first 100 days of research.

- Sales velocity compresses. Shorter leadership cycles mean decisions need to be influenced earlier, before internal change resets priorities.

What this churn tells us is that leadership stability, once a reliable constant in B2B buying, is now a variable. The companies thriving in this new reality are the ones using live data to adapt faster than their buyers can move.

“When a new leader steps in, they review everything. The tech, the processes, the partnerships. Those first 100 days reset priorities, buying committees and budgets. Understanding when those changes happen is critical because it tells you exactly when problems are being re-evaluated and where new investment decisions will be made.”

Chris Evans, CRO at Cognism

.png?width=600&height=423&name=CFO).png)

*These are mean averages.

But turnover alone doesn’t tell the whole story; it’s what leaders do in those first few months that reshapes markets

Every leadership change is a buying signal

Leadership turnover isn’t just a headline stat; it’s a go-to-market signal hiding in plain sight. One in ten senior leaders in France, and over 7% in the UK, changed employers in the past 6 months. But the real story isn’t just who’s moving, it’s what happens next.

When new leaders take the reins, they bring new playbooks, new priorities, and often, new vendors. 70% of C-Suite leaders spend their budget within the first 100 days of their new role. In practice, this means that go-to-market and RevOps teams are now operating in a world of continuous reevaluation, where every executive transition resets the buying committee. It also narrows the window in which buyers are actively considering change. What used to be an occasional in-market moment now appears more frequently, meaning marketing must be ready to influence these short decision cycles as they open.

There is one very practical implication here. Data freshness is non-negotiable. Account maps age faster, org charts shift overnight, and buying committees look different every quarter. If your CRM data is six months old, it’s already outdated.

Insight spotlight: France loves a long title. A “Directeur Général” in France is often equivalent to a CEO, while “Directeur Commercial” translates roughly to Chief Revenue Officer. But tread carefully - a “Président” may not be the top exec, but the board chair!

The pathway to the C-suite is changing

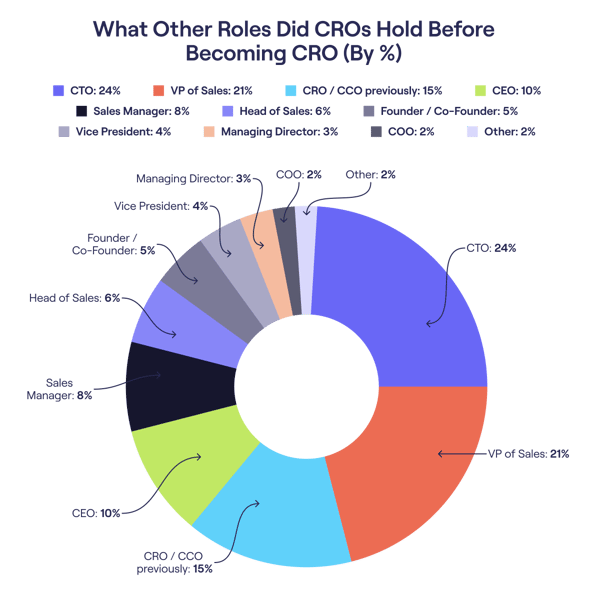

Shorter tenures are reshaping the traditional path to the top. As leadership cycles compress, the route to the CRO chair is no longer linear, and it’s no longer owned by sales.

Cognism’s decision maker data reveals that today’s Chief Revenue Officers come from a more diverse set of functions than ever before. While VPs of Sales and Sales Managers still represent a significant share, there’s a growing influx of technologists, product leaders, and founders stepping into revenue roles.

- VP of Sales and Sales Managers remain the two most common feeder roles.

- But CTOs and Product leaders now account for a noticeable portion of transitions, signalling how revenue strategy is increasingly tied to product-led initiatives and data visibility.

- A meaningful percentage of CROs also previously held Founder or Managing Director titles, showing the rising influence of entrepreneurial and operational experience in revenue leadership.

The picture that emerges is one of cross-functional evolution. As businesses unify data, marketing, product, and sales around shared revenue goals, the modern CRO is no longer a single-track salesperson; they’re a systems thinker, balancing commercial acumen with technical and operational oversight.

“The CRO role has evolved into a full end-to-end customer experience function. It now spans brand, demand generation, sales execution, retention, expansion, and the partnership with product and engineering. A modern CRO needs to connect the go-to-market roadmap with the product roadmap and align every touchpoint across the customer lifecycle.”

Chris Evans, CRO at Cognism

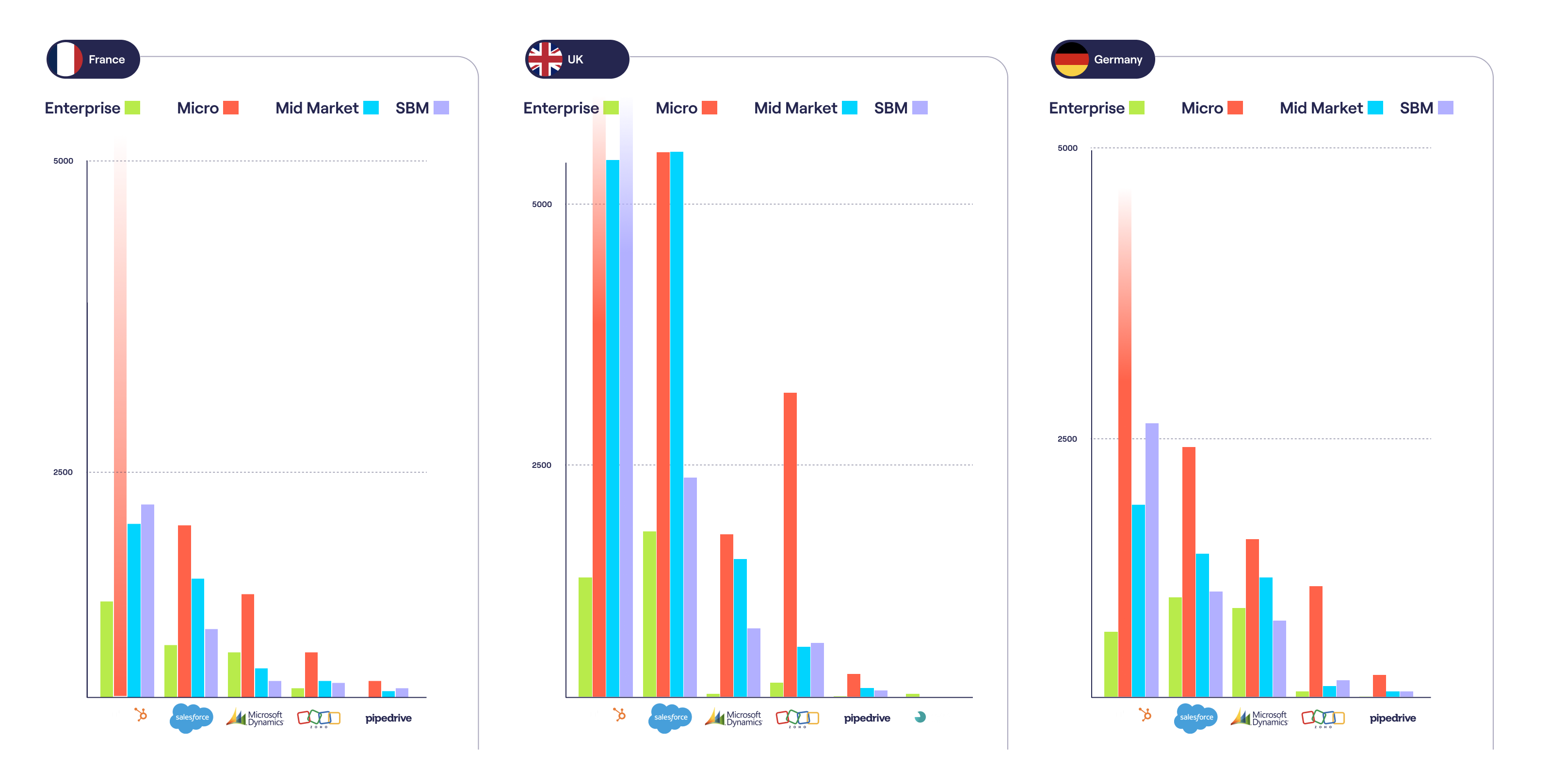

The GTM tech stack is consolidating

The era of sprawling, disconnected toolchains is giving way to focus.

Cognism’s technographic data shows a clear consolidation trend in go-to-market technology. Across CRMs, sales engagement, and data orchestration tools, a smaller cohort of vendors now account for the vast majority of market share. The “try-everything” phase of martech experimentation is being replaced by a focus on integration, performance visibility, and data fidelity.

In CRM, the pattern is consistent across all major regions. HubSpot has become the most deployed platform globally, leading outright in small and mid-market segments thanks to its usability and all-in-one ecosystem. Meanwhile, Salesforce continues to dominate the enterprise, cementing its position as the system of record for large-scale, multi-region organisations.

In sales engagement, Salesloft has emerged as the clear global leader, with three times as many deployments as Gong or Outreach. Its growth trajectory suggests not just preference, but consolidation - fewer teams are running multiple point solutions for sequencing, analytics, and coaching. Instead, they’re choosing a primary platform and embedding it deeply into their sales motion.

Consolidation is most pronounced in slower-growth regions, particularly across Europe. This reflects a shift toward maturity and cost discipline, where budget pressure is higher, efficiency takes precedence over novelty. The strongest-performing teams are unifying data and workflows under fewer, better-integrated systems.

This rationalisation has important implications for the GTM strategy. With stacks shrinking and integrations deepening, competitive advantage is moving away from tool count and toward data strength, the quality, accessibility, and interoperability of the information flowing between platforms.

A related emerging pattern is the shift toward conversational interfaces becoming a central access point for many tools. As more AI assistants sit between users and their systems, vendors will need to ensure their products can plug into these interfaces cleanly and reliably, reinforcing the move toward deeper integration rather than broader tool expansion.

“Many organisations optimise their tech stack quarter-to-quarter rather than on a one-to-three-year horizon. Consolidation isn’t just about cutting tools, it’s about understanding where the market is moving and where long-term efficiency gains can actually come from.”

Chris Evans, CRO at Cognism

But this consolidation also raises a question for the future: If all-in-one ecosystems continue to dominate, will suppliers risk becoming generalists, offering breadth at the expense of depth? For now, buyers appear comfortable trading specialisation for simplicity, but the next wave of innovation may depend on how seamlessly these platforms can stay open, integrated, and intelligent without losing focus.

Chris adds:

“The pattern we see in the market is clear: systems and workflows can change, but the requirement for clean, accurate data flowing through them does not. As stacks consolidate, data strength becomes the foundation that determines how well the rest of the GTM ecosystem performs.”

Governance, privacy, and the new trust economy

As companies consolidate their go-to-market stacks, they’re also tightening the systems that govern data itself.

Cognism’s dataset shows that privacy and governance roles now represent around 1% of all company-wide leadership, but nearly one-fifth of modern legal teams.

|

Category |

% of all company roles |

% within legal teams |

|

Privacy / Data Protection titles (e.g., DPO, Head of Privacy, Privacy Counsel) |

0.4% |

7.9% |

|

Governance titles (e.g., Head of Governance, Compliance & Governance Manager) |

0.6% |

11.2% |

|

Combined privacy & governance titles |

~1.0% of all roles |

~19% of all legal-function roles |

This shift signals how GDPR, ESG, and AI regulation are reshaping legal departments from reactive compliance hubs into strategic guardians of trust and data ethics.

“There’s been a wave of major compliance events, the EU AI Act, NIS2 for cybersecurity, ongoing GDPR evolution, the EU Data Act, and the UK’s Data Use and Access Act. Every region now carries different requirements, which is why privacy and governance roles have become a critical part of modern legal teams.”

Chris Evans, CRO at Cognism

As tech stacks consolidate, so too are market strategies. Efficiency isn’t just shaping the tools companies use; it’s influencing where they build and grow.

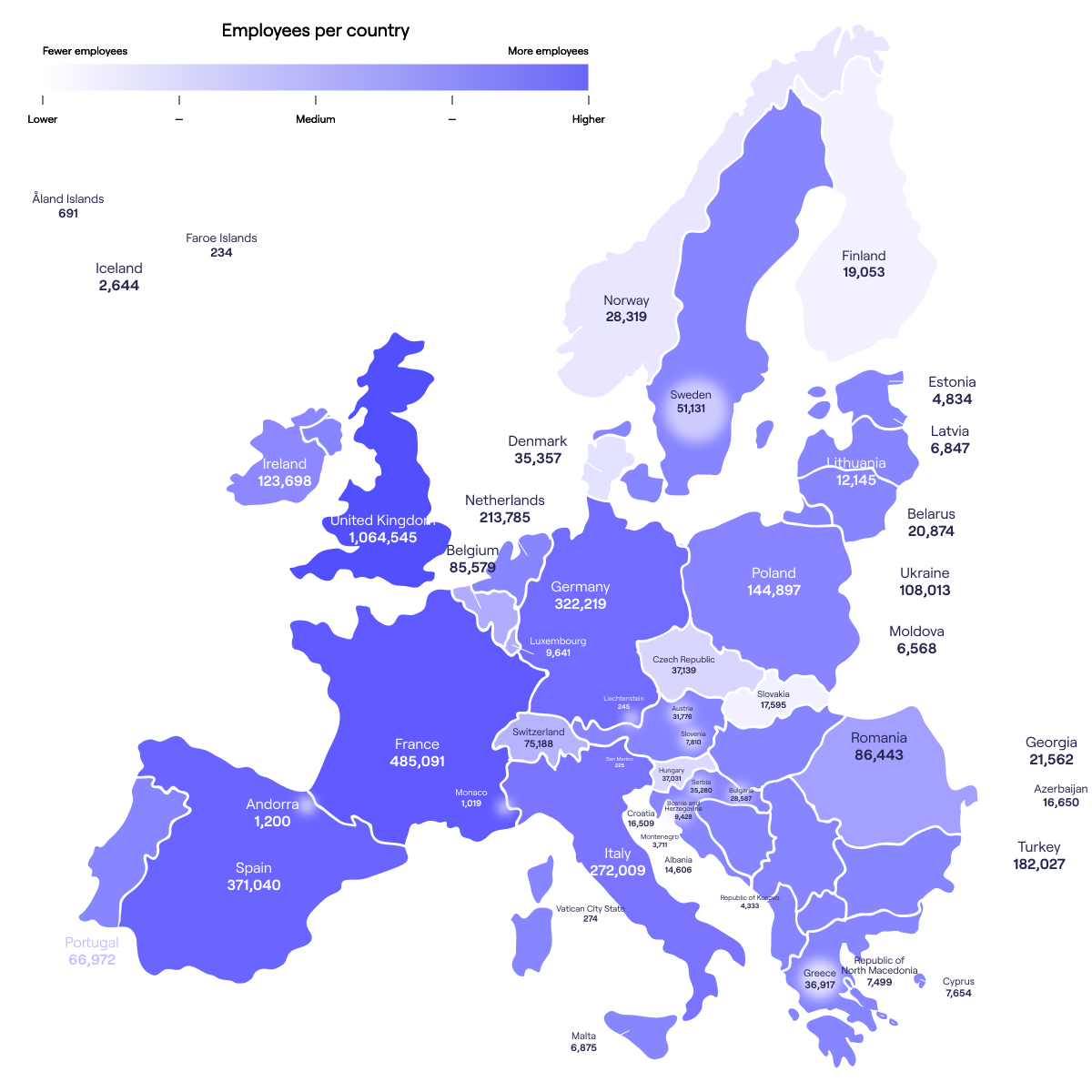

Transatlantic expansion persists: UK still the launchpad

Even amid ongoing trade and regulatory uncertainty, the transatlantic corridor remains remarkably resilient. Cognism’s employment data shows that US companies are not pulling back from Europe, they’re recalibrating how and where they grow.

The United Kingdom remains the primary entry point for US firms expanding across the continent. Over 1 million employees of US-headquartered companies now work in the UK, which is more than double that of France (485K), and well ahead of Spain (371K) and Germany (322K).

This reinforces the UK’s position as the operational and cultural bridgehead for transatlantic expansion. Despite Brexit’s enduring political footprint, it has not materially altered investment or hiring patterns. For many US companies, the UK’s shared language, legal alignment, and mature services ecosystem still outweigh any friction at the border.

However, what has changed is why companies expand.

Where market opportunities fueled the pre-2020s wave of transatlantic growth, today’s expansions are driven by efficiency and proximity, with shared service centres, revenue operations hubs, and European customer success teams. The UK remains the starting point, but not always the final destination; firms increasingly use it as a staging ground to reach customers and talent across EMEA.

The result is a Europe strategy built less on footprint and more on function: leaner, data-driven, and anchored around performance hubs that balance cost, language, and access to skilled labour.

“The UK is the natural starting point for US businesses because of language, consumer behaviour similarities and the ability to establish a presence before navigating the different language and compliance requirements across Europe.”

Chris Evans, CRO at Cognism

These structural shifts echo in buyer behaviour. The topics attracting the most interest - automation, AI, and sustainability - are the same forces redefining how and where businesses expand.

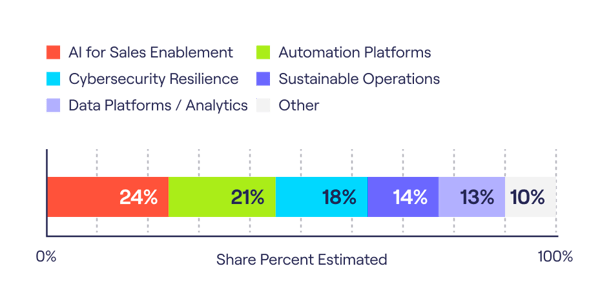

Buyer intent: Automation, AI, and sustainability stay on top

Cognism’s intent data continues to highlight a clear throughline in global buyer priorities: efficiency, intelligence, and impact.

We estimate that 7 in 10 intent topics tracked relate to technologies either powered by or significantly influenced by AI, from automation and machine learning to predictive analytics. It confirms that buyers are prioritising intelligence over expansion.

- UK & US: ~75% of intent signals AI-related (dominated by automation, analytics, and enablement).

- France & Germany: ~60%, with higher concentration around compliance, sustainability, and industrial AI.

In Q4 2025, three topics in particular showed notable momentum:

- AI for sales productivity: Searches and buying signals rose sharply across all markets, especially in the US and UK. Businesses are moving from experimental pilots to embedded AI workflows, using generative models to power lead scoring, messaging, and sales productivity.

- Cybersecurity resilience: A surge in intent across mid-market and enterprise segments indicates that automation investments are being balanced by risk mitigation. As companies scale digital operations, protecting data integrity has become a board-level concern.

- Sustainable operations: Particularly strong in France and Germany, sustainability-related buying signals rose quarter-over-quarter, suggesting that climate commitments are now being operationalised, not just reported.

These themes closely mirror the structural shifts observed across leadership changes, stack consolidation and governance.

Taken together, the intent data paints a picture of buyers optimising, not expanding. Rather than chasing new categories, they’re prioritising tools that increase output per headcount - productivity, intelligence, and cost efficiency remain the dominant value levers heading into 2026.

“As AI-powered tools become embedded in daily GTM workflows, the real differentiator won’t be the models themselves, but the data infrastructure beneath them. Without high-quality, secure data, AI models will fail. It is not a case of just putting AI on your current workflows, if your data quality is not strong, the model will fail.”

Chris Evans, CRO at Cognism

Expert perspectives: What it all means for 2026

The signals in this report point to a business environment defined by continuous movement. Leadership turns over more quickly, buyer priorities shift mid-cycle, and tech stacks evolve faster than most organisations can evaluate them. What was once a predictable GTM landscape is now a set of interdependent changes happening at the same time across people, platforms, and processes.

Chris Evans, Cognism's CRO, notes that the biggest challenge for revenue organisations today is the growing gap between how fast markets change and how slowly many companies adapt. Annual plans built on last year’s assumptions lose relevance when teams cannot see, understand, or respond to organisational shifts in real time.

Cognism’s dataset makes the pattern clear: GTM resilience now depends on the ability to interpret live signals and act on them quickly. Without visibility into who has moved, which systems are consolidating, or where intent is emerging, strategies drift out of sync with buyer reality. The companies that struggle to adapt miss the brief windows where priorities reset and decisions are made.

The rise of AI intensifies this pressure. The challenge isn’t the tools themselves, but the workflows, processes and decision cycles that remain anchored to outdated information. This places greater expectations on RevOps, product, legal, and leadership teams to build stronger, more unified data foundations.

Across leadership churn, tech consolidation, governance growth, AI adoption and evolving CRO pathways, one theme stands out. Organisations are rebuilding their GTM foundations around clarity, precision, and interoperability. Leaders no longer need more dashboards; they need information that reflects what is happening now inside the accounts they are targeting, and systems capable of acting on that information without friction.

As Chris highlights, the companies that will outperform in 2026 are the ones that treat change as a strategic input. They track movement continuously, align teams around shared data, and design workflows that move at the same pace as their buyers. In a market defined by speed, advantage belongs to the organisations that see the shift first and respond with confidence.

Conclusion

2025 has not been the year of slowdown - it’s been the year of recalibration. Cognism’s data shows that even in a climate of caution, business leaders are building smarter, leaner, and more resilient foundations for the next growth cycle.

C-Suite on the move: Track leadership movements in our monthly report

Our monthly reports track the latest C-Suite job changes, helping you identify and engage decision-makers as they step into their new roles. Download our latest report to see which leaders have moved and opt in to get future updates delivered at the start of each month.

(C-Suite) This year (total) This week (vs last)